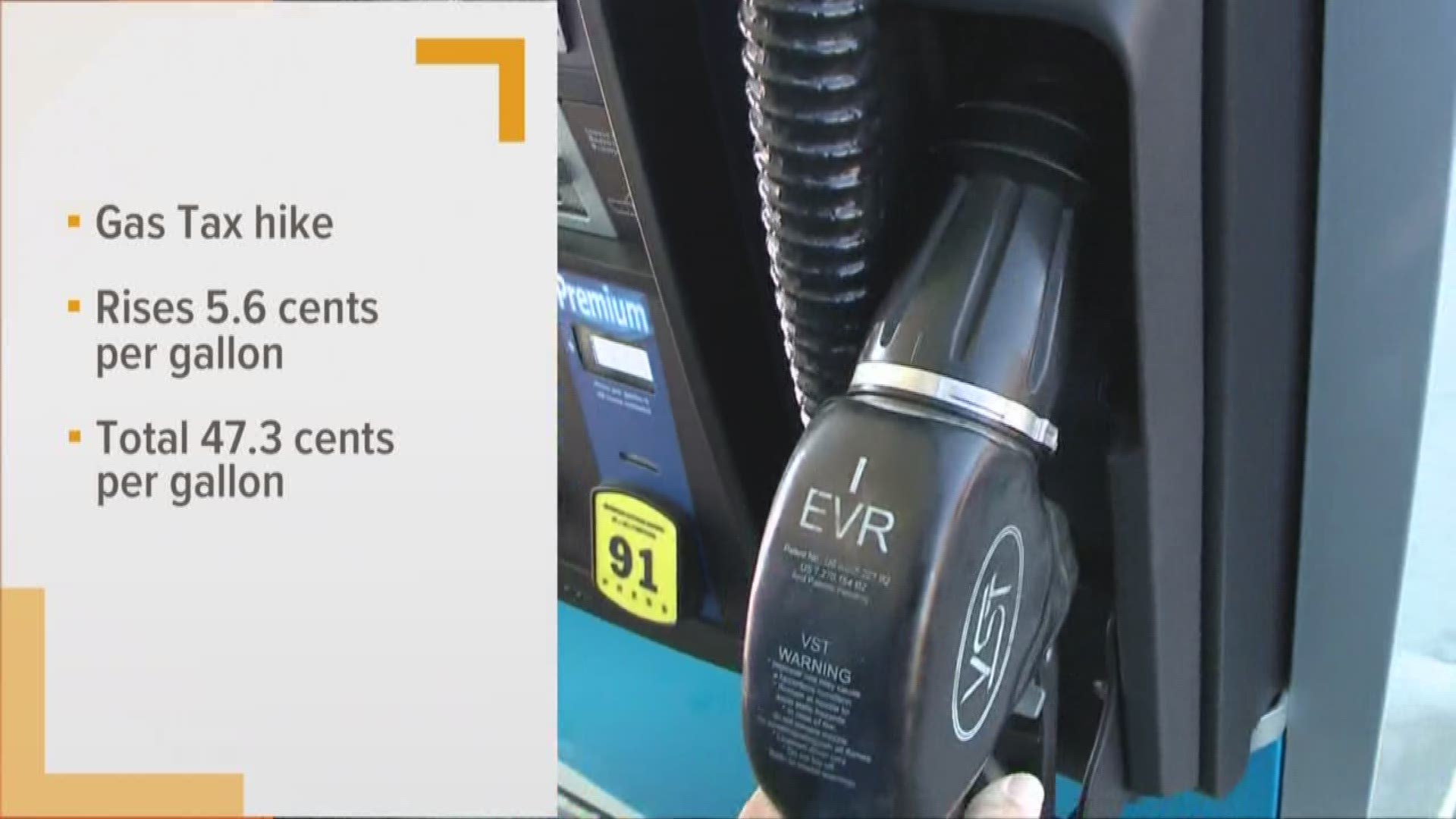

SACRAMENTO, Calif. — California's newest gas tax increase goes into effect July 1, which may leave you wondering how much it's going to cost you at the pump.

We looked up the best selling cars in California and crunched some numbers to give you an idea of your annual gas tax tab now that we're paying an extra 5.6 cents a gallon.

We based our figures on six popular 2010 vehicle models driving 15,291 miles each year. 15,291 is pretty specific. We chose that because according to the U.S. Department of Transportation, that's the average amount of miles driven by people between the ages of 35 and 54.

RELATED: Live Traffic Maps

RELATED: Lowest gas prices in Sacramento

Currently, California taxes $0.473 per gallon of gas and federal taxes are $0.184 per gallon. Below stats are based on driving those 15,291 miles annually:

Honda Civic

- Miles per gallon: 29

- New state gas tax ($0.056/gallon): $29.53

- Total state gas tax ($0.473/gallon): $249.40

- Federal gas tax ($0.184/gallon): $97.02

- Total: $346.42

Toyota Camry

- Miles per gallon: 26

- New state gas tax: $32.93

- Total state gas tax: $278.18

- Federal gas tax: $108.21

- Total: $386.39

Toyota Highlander

- Miles per gallon: 19

- New state gas tax: $45.07

- Total state gas tax: $380.67

- Federal gas tax: $148.08

- Total: $528.75

Toyota Rav4

- Miles per gallon: 24

- New state gas tax: $35.68

- Total state gas tax: $301.36

- Federal gas tax: $117.23

- Total: $418.59

Ford F-150

- Miles per gallon: 16

- New state gas tax: $53.52

- Total state gas tax: $452.04

- Federal gas tax: $175.85

- Total: $627.89

Mercedes Benz

- Miles per gallon: 21

- New state gas tax: $40.78

- Total state gas tax: $344.41

- Federal gas tax: $133.98

- Total: $478.39

WATCH MORE: How to save money on gas | Begley's Bargains