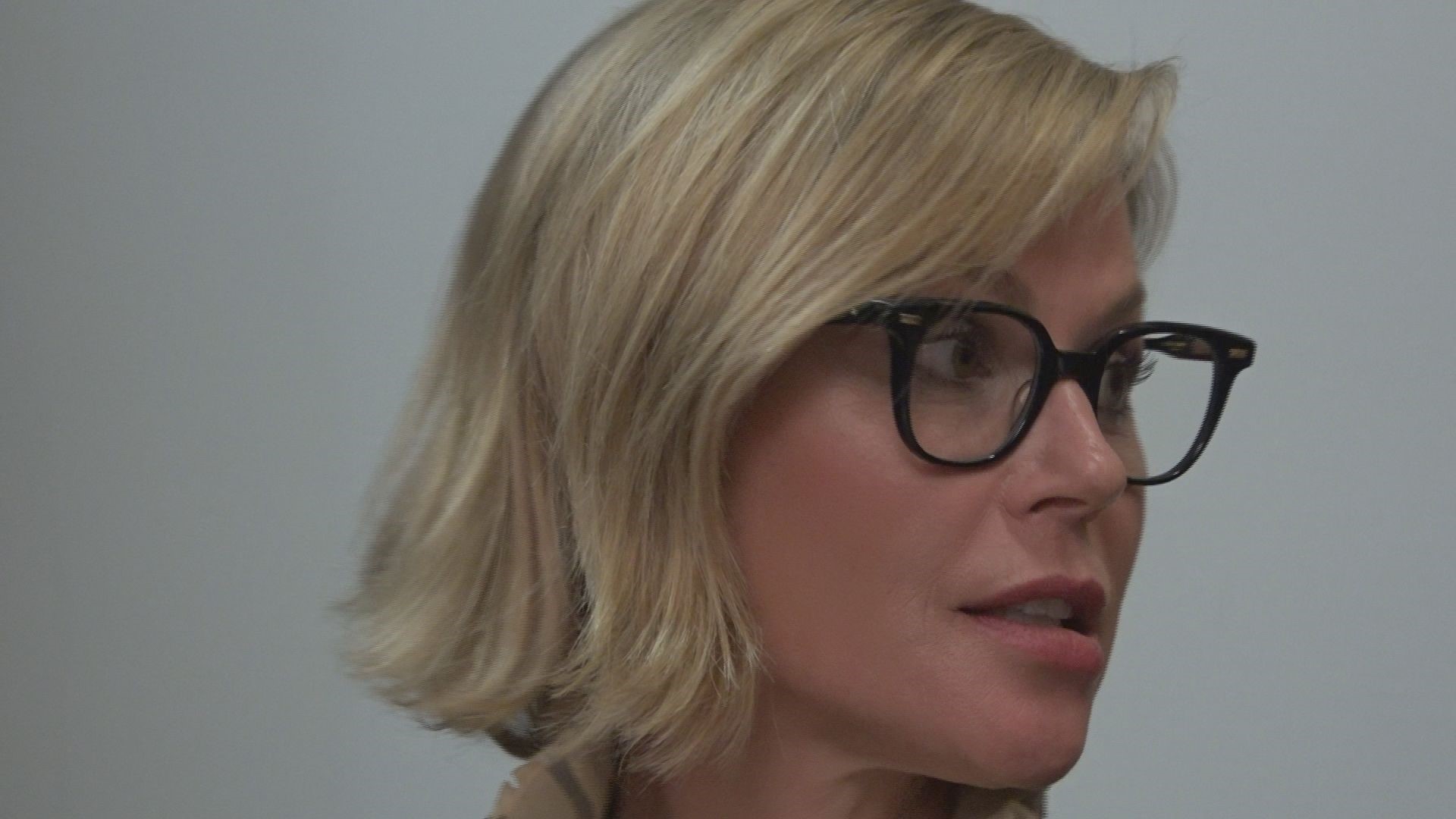

Actress Julie Bowen joined lawmakers at the state capitol building Thursday to lobby for a temporary repeal of the state’s diaper tax.

All diapers in California are subject to state sales taxes. If passed, Assembly Bill 66 (AB 66) would exempt child diapers from that state sales tax until 2025.

“This bill would offer just over $100 a year in tax relief,” said Bowen, who plays a mother on ABC’s Modern Family and is a mother in real life. “That’s enormous to families that are literally choosing between food and diapers.”

Bowen is also an ambassador and board member for Baby2Baby. The non-profit provides diapers, clothing, and other basic necessities to children up to 12-years-old who are living in poverty.

The national organization has distributed 50 million items including 29 million diapers to children in poverty over the last seven years. Those children are in homeless shelters, domestic violence programs, foster care, hospitals, underserved schools and survivors of disasters, according to the organization's website.

“At Baby2Baby, we distribute all basic essentials to children in poverty but it’s diapers every single time,” said Norah Weinstein, the Co-President of Baby2Baby. “That’s the first thing that the families ask for. It’s the most basic.”

An average child will use more than 2,700 diapers in their first year, according to a report by the financial website Investopedia. That can add up to more than $550 per year.

Based on an average combined state and local sales tax of 8.25 percent, parents would be paying more than $45 per year in tax in diapers.

Assembly Member Lorena Gonzalez (D-San Diego) who authored the bill, said families could be paying upwards of $120 per year in tax on diapers. Repealing the tax on diapers would result in a loss of an estimated $36 million tax revenue, Gonzalez said.

“When people have kids it’s usually their most vulnerable time and the time when they most need some help,” Gonzalez said. “One of the things that doesn’t make sense is that we’ve taxed diapers, even though it’s an absolute health necessity.”

One in three families in the United States experience a struggle to provide diapers at some point in their child’s life, according to a report by California State University Fresno.

PREVIOUS WORK ON DIAPER TAX

Gonzalez sponsored two similar bills previously, but neither became state law.

- Assembly Bill 717 - proposed in 2015 would have exempted diapers from sales tax but was vetoed by then Governor Jerry Brown.

- Assembly Bill 479 - In 2017, Gonzalez proposed a bill that would repeal the state sales tax on both diapers and feminine health product such as tampons and pads.

- To make up for a loss in tax revenue, she proposed a $1.20 additional flat tax per gallon of hard liquor sold in California.

- AB 479 failed to make it out of committee.