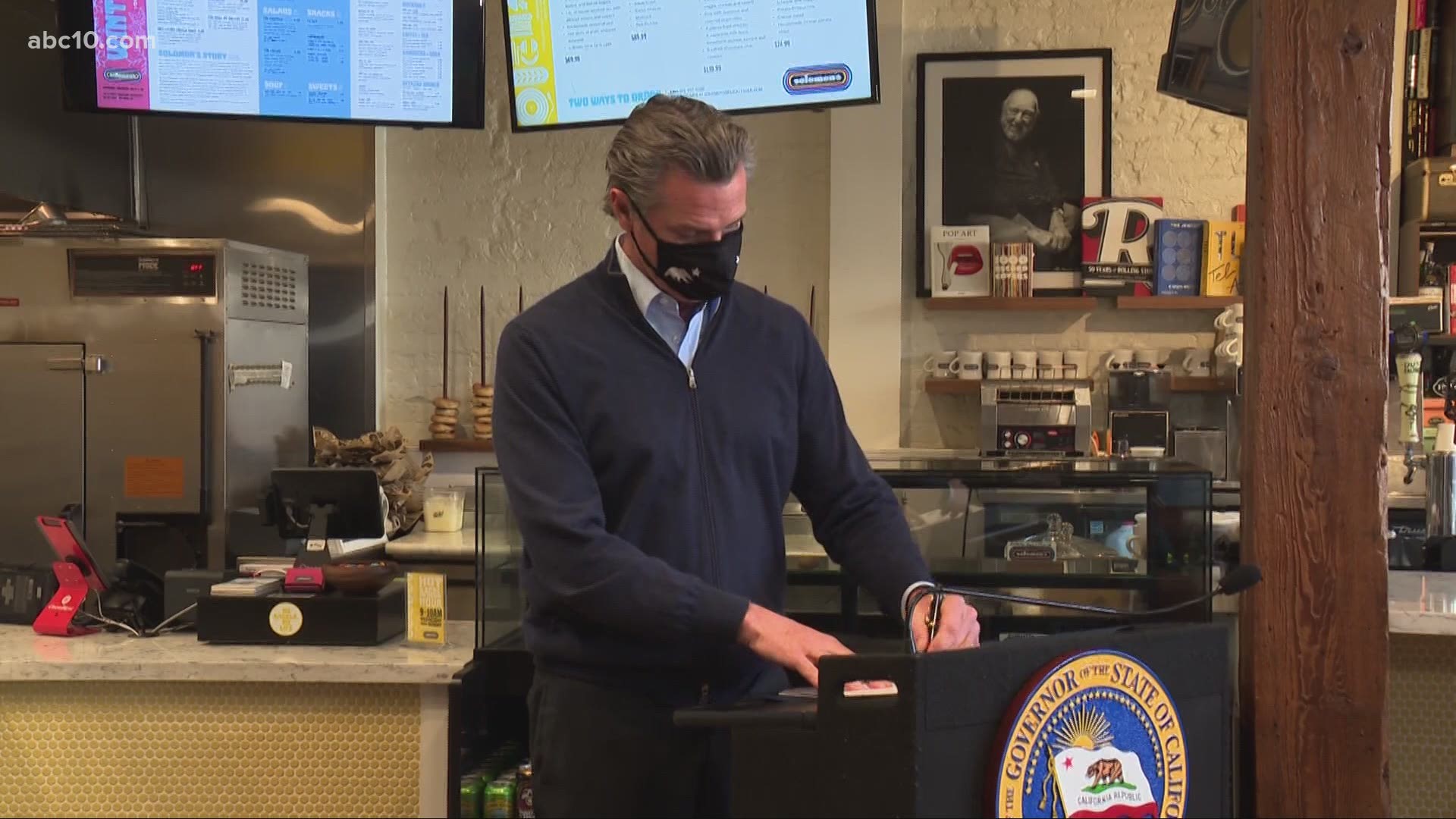

SACRAMENTO, Calif. — Gov. Gavin Newsom recently signed the $7.6 billion “Golden State Stimulus” coronavirus relief package into law, and one very large part of the package is more than $2 billion in grants for struggling small businesses.

“The backbone of our economy is small business. We recognize the stress, the strain that so many small businesses have been under and we recognize our responsibility to do more and to do better to help support these small businesses through this very difficult and trying time,” Newsom said.

Businesses with annual revenues between $1,000 and $2.5 million are eligible for the funds. Grants will range from $5,000 to $25,000, with a priority given to businesses owned by women and minorities and businesses in areas with high unemployment rates.

Money from this package builds upon the $500 million that has already been distributed to small businesses since the pandemic began.

“And I want to remind you these are grants, not loans – a profoundly important distinction,” Newsom said.

The package will also cancel the fees associated with licenses like cosmetology, barbering, and alcoholic beverages, for the next two years.

“The 59,000 businesses that have ABC licenses, some of those license fees are as much as $1,285. We’re waving those fees, not once, but over a two-year period. And that’s in addition to these small business [grants]. That’s the relief being provided in this package as well,” Newsom said.

Another $50 million in grants was also set aside for cultural institutions.

Prospective businesses need to have the following documents ready before applying:

1. Application Certification: Signed certification used to certify your business

2. Business Financial Information:

Most recent tax return filed (2019 or 2018) – provided in an electronic form for online upload, such as PDF/JPEG or other approved upload format. Copy of official filing with the California Secretary of State, if applicable, or local municipality for the business such as one of the following: Articles of Incorporation, Certificate of Organization, Fictitious Name of Registration or Government-Issued Business License.

3. Government Issued Photo ID: Such as a Driver’s License or Passport

Community-based and language-specific partners

Small business owners may also wish to apply through county-specific community partners. Tap here to see which community partners are available in your county.

Language-specific partners are also available. Tap here to learn more.

How will grant recipients be determined?

After eligibility is established, businesses that receive grants will be scored “based on COVID-19 impact factors incorporated into the Program’s priority criteria so that distribution can take into account priority key factors,” according to the program website. Those factors are as follows:

- Geographic distribution based on COVID-19 health and safety restrictions following California’s Blueprint for a Safer Economy and county status and the new Regional Stay at Home Order;

- Industry sectors most impacted by the pandemic; and

- Underserved small business groups served by the State-supported network of small business centers. Underserved includes the following: businesses majority-owned and run on a daily basis by women, minorities/persons of color, veterans, and businesses located in low-wealth and rural communities).

- Disadvantaged communities tracked by socio-economic indicators (i.e., low-moderate income, poverty rates, unemployment, educational attainment, and other disadvantaging factors).

Read more from ABC10

WATCH MORE: Gov. Newsom signs Golden State Stimulus Bill