Here's a bittersweet stat to ponder the day after Christmas: The average American takes on more than $1,000 in debt to pay for the holidays, rather than play the part of Scrooge.

The giving is sweet, but this kind of debt is the financial equivalent of fruitcake — no one really wants it and it can stay with you a really long time.

In this article, we've got a simple savings hack to make it as painless as possible to be on the right side of the debt statistic next holiday season (it's also a handy way to save for any big spending you only do once a year of so).

There's $3,326 of credit card debt per adult in this country, which is the highest it's been since the end of the year 2008-- when the housing market collapsed and the Great Recession set in.

The holidays shouldn't be part of that problem for you. This is spending you can (and should) absolutely predict since it happens every year. Here's the trick:

DIVIDE 26

It's not exotic math, but it works! If you need a chunk of money once a year, divide it by 26.

Why 26? Almost all of us living off of paychecks get 26 paychecks per year because we're paid every other week. However, if you get paid monthly you should divide by 12 and if you get paid twice a month, divide by 24. Below you see the math in action.

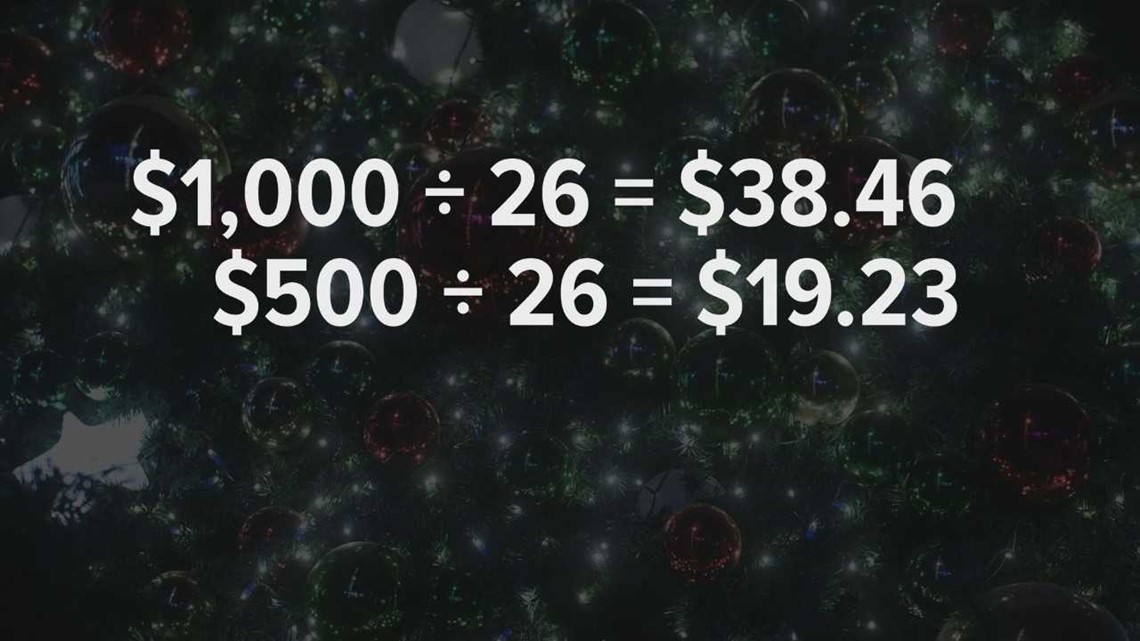

It's really hard to come up with $1,000 all of a sudden one month, especially if you're living paycheck-to-paycheck. But if you divide it by 26, you're only talking about $38.46 per paycheck.

If you can't swing that, then pick a number that works for you and use the savings as your budget. You can get to $500 by saving about $19 per paycheck over the course of the year.

AUTOMATIC TRANSFERS

It may sound like a pain to set this up, but it's less of a pain than having to pay back debt — and thanks to online banking, it's actually become simple to set up yourself.

Most banks allow you to set up recurring, automatic transfers for free online. If your bank doesn't do this-- or doesn't allow you to schedule transfers on your pay schedule, time to shop around for a new bank that does (ore on choosing banks below).

In fact, you may want to shop for a second bank in which to stash your savings even if you love the bank you use for checking. This way, you don't have to look at your savings every time you log on to pay your monthly bills — you'll just see the withdrawals coming out each time you're paid.

Depending on your employer's payroll and the speed of the banks you choose, you may have to do some trial-and-error to get the timing the way you want it.

For instance, I get paid every other Friday, but my savings accounts all initiate their withdrawals on the Thursday before — and the timing works perfectly. You may want to start out by scheduling your automatic transfers on your actual payday, and then adjust from there as desired.

Alternatively, most employers will let you split your direct deposit into multiple different accounts. But I like the flexibility to make changes about how much I'm saving in different accounts whenever I want. About those accounts...

OPEN A SAVINGS ACCOUNT, OR 10 OF THEM!

People usually look at me like I've got two heads when I tell them that I have fifteen different savings accounts.

Well, I do.

I'll admit, it's a little bizarre — but each account has a purpose. I save a little every paycheck for holiday gifts, vacationing, car repair, veterinary bills, and a bunch of other things that don't come up every month.

I've also got an emergency fund, which is something you absolutely should have — and regularly scheduled transfers are a great way to get going.

It'll take a year to get going and perhaps some short-term adjustment to get used to living without the money you're saving-- but the sense of freedom that comes from having the money when you need it is hard to put a price on.

I'm not alone on this. More banks are catering to this kind of savings. The folks at Nerdwallet have a list of a half dozen banks that offer multiple accounts.

My savings bank (CapitalOne 360, formerly ING Direct — and no, they didn't pay me to write about them) allows you to open up to 25 different accounts all with a single sign-in...and give each one a name.

One note: the interest on savings accounts has been lower than inflation for a long time now. If you're looking to stash away money for a longer-term goal like retirement or college tuition, it's a great idea to save a little from each paycheck, but you may want to consider researching investment strategies rather than leaving it where you'll earn relatively little interest.

If that all sounds a little daunting — consider starting out with just a savings account for the holidays.

You'll be ahead of most Americans and it will make it easier to keep your credit score on the "nice" list.

Got a financial hack or story tip to share with us? Shoot Brandon Rittiman an email at brittiman@abc10.com.