SACRAMENTO, Calif — It's getting harder to afford a home in California.

Julie Debbs is a proud Black grandmother with eight grandchildren. She's been living in Sacramento's Oak Park neighborhood for 47 years. Debbs mostly relies on Social Security to make ends meet, and just like everyone else, Debbs does not want to be without a home in California.

"It's a little scary; I'm not even going to lie," Debbs said. "I was homeless before for 3 years. Now, I'm renting a townhome, but they keep going up on the rent. I'm on a fixed income, and it's really hard."

Debbs has been renting the same two-bedroom and one-bathroom townhome in Oak Park since June 2014. When she first moved into the home, Debbs said she was paying $699 in rent. Now, the rent is $1,400.

"I would love to own a home, but how?," Debbs asked. "The houses are so high now. Everything is just going up. The little bit that you do save, you're going to eventually spend it on something that you need. So, for right now, I'm renting. But, I'm thankful I have a roof over my head."

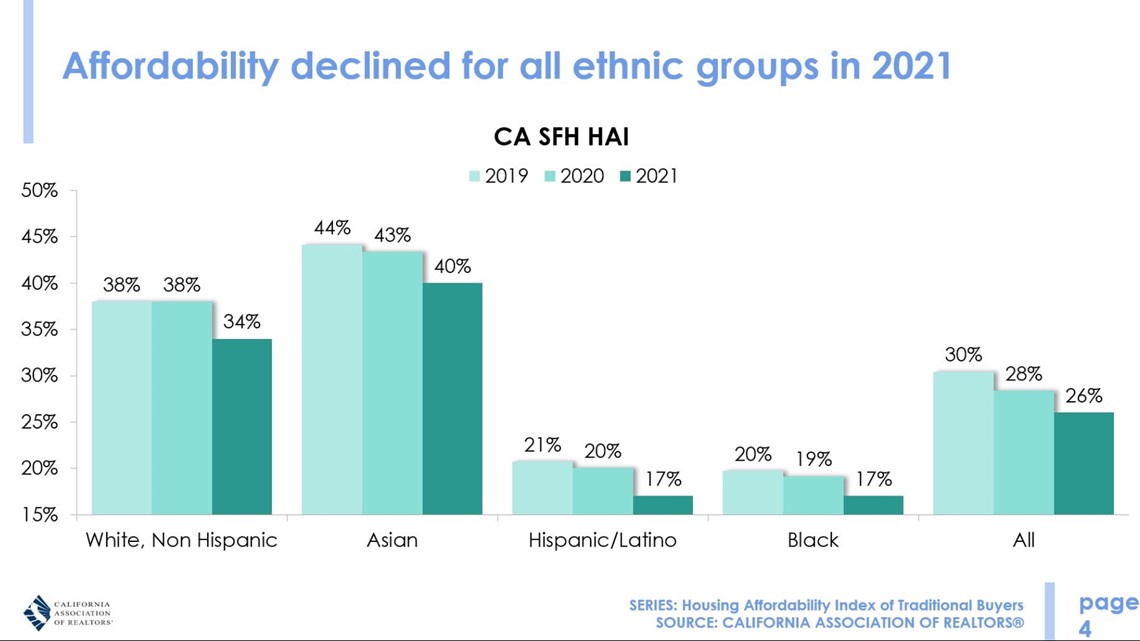

When it comes to the lack of homeownership, Debbs is not alone. Housing affordability deteriorated for all Californians in 2021, largely due to home prices skyrocketing during the COVID-19 pandemic, according to a report released last month from the California Association of Realtors (CAR), a statewide trade association dedicated to the advancement of professionalism in real estate.

The report shows only 26% of all Californians earned the minimum income needed to purchase a home in 2021, down from 28% in 2020. A household would need a minimum annual income of $144,400 to purchase a $786,750 statewide median-priced, existing single-family home.

"Homeownership has an unparalleled ability to provide stability and economic security for working families and is vital to the health of our state and its citizens because it strengthens communities across California," said Otto Catrina, CAR president.

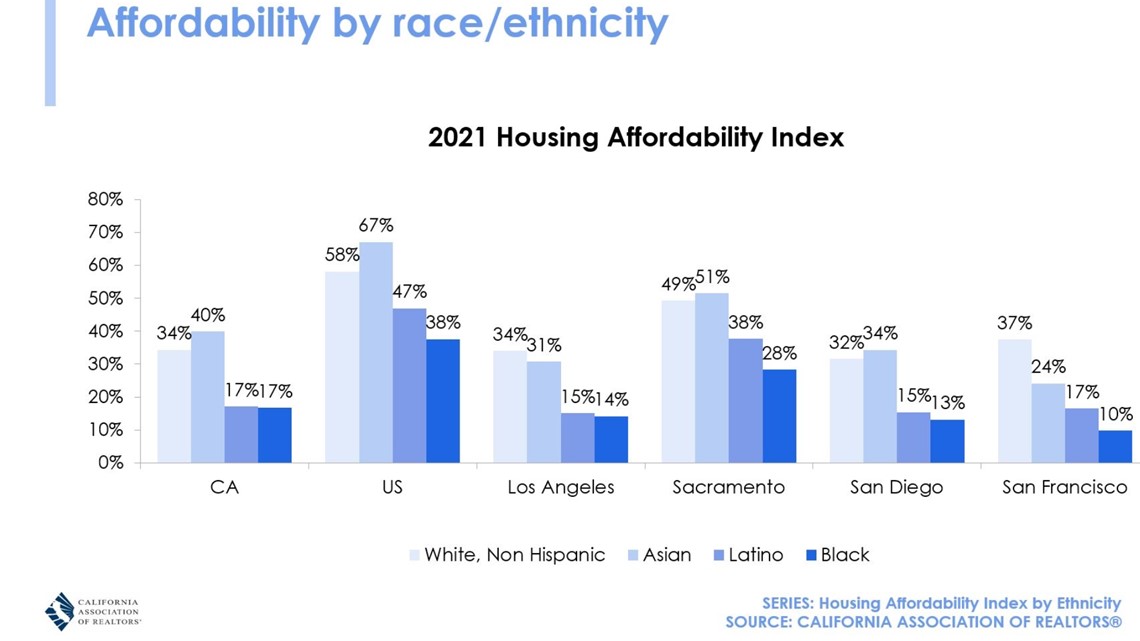

Based on the same report, California's housing crisis impacts people of color more than others. 34% of white households were able to afford a median-priced home in 2021, down from 38% in 2020.

But, only 17% of Black and Latino households could afford a median-priced home in California, down from 19% and 20% in 2020, respectively. That's less than one in five Black and Latino households.

The significant difference in housing affordability for Black and Latino households illustrates the racial homeownership gap and wealth disparity for some communities of color, which could worsen as rates rise further in 2022.

"Promoting access to homeownership is one way to close the racial wealth gap and foster economic equity for all Californians," Catrina said. CAR is committed to addressing ongoing fair housing and equity issues that persist in our state that have made it harder for Blacks, Latinos and other underserved communities to access and afford housing."

When it comes to housing affordability by race, the CAR report also shows, people of Asian descent can afford a home in California more than any other group. 40% of Asian homebuyers could purchase a median-priced home in 2021, down from 43% in 2020.

Housing affordability is significantly based on income, among other things, but research shows, more work is needed to close the racial wealth gap in California. In 2021, the statewide median income for white people was $102,540, $116,060 for Asians, $71,120 for Latinos and $61,740 for Black people - that's a more than $20,000 income gap between the overall population.

"In Sacramento County, unfortunately, it is the least affordable place for Black families," said Dwayne Crenshaw, president and CEO of the Greater Sacramento Urban League. "The housing prices are skyrocketing, but income is not skyrocketing. The generational wealth gap that has been created overtime has made it even harder for Black and Brown families to access the capital for a down payment on a house. They don't have homes being transferred between families for equity, so it's a real challenge."

The Greater Sacramento Urban League is on a mission to provide underrepresented youth and adults with educational, career training and employment opportunities to achieve economic self-reliance.

The nonprofit organization is also working to close the racial homeownership and wealth gap by offering free programs and counseling assistance to the public. That includes help with homelessness, rental assistance, first-time home buyers, home buyer certification, financial literacy and more.

"Just last week, we launched a Financial Empowerment Program to help people with their debt management, get out of debt, learn how to budget and save and to learn about the challenges of homeownership," Crenshaw said. "All of us, whether we have a lot of money, no money, or some money, need financial planning."

► Get more stories about race and culture: Sign up for our newsletter at www.abc10.com/email and find more online in our Race & Culture section.

WATCH ALSO: