SACRAMENTO, Calif —

The novel coronavirus is causing over a million Californians to lose income, but resources are becoming more available to allow customers to pay for their bills later.

While companies are letting customers defer their payment, this does not mean that they are off the hook from paying off their debts.

Here is what you can do to help pay for your bills as the April 1 deadline looms. You can also call 211 to find more resources.

Rent

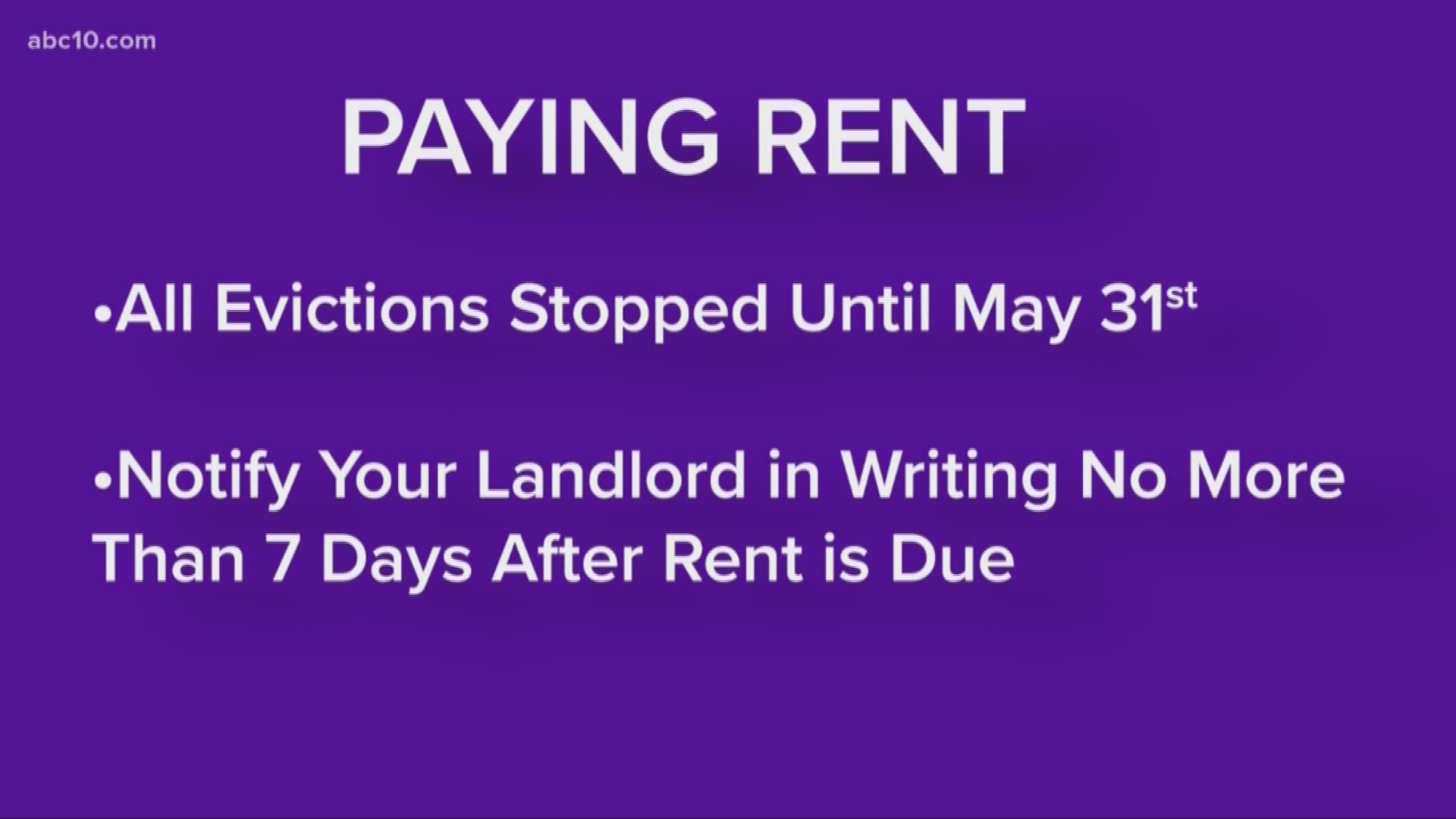

Gov. Gavin Newsom issued an executive order that prevents landlords from evicting those who cannot pay rent because of the coronavirus pandemic. The order lasts through May 31.

The catch is that you would have to notify your landlord in writing no more than seven days when the bill is due.

Newsom recommends paying as much of the rent that you can and save any financial documentation. Contact legal help if your landlord is trying to evict you even if you follow these steps, according to the governor’s office.

READ MORE:

Mortgage forbearance

Newsom also announced last week a relief package that would help homeowners impacted by the coronavirus. Hundreds of financial institutions offered mortgage forbearance, which generally means that if you ask for help on your mortgage from the bank and qualify, then you don’t have to make your payment at this time.

Some big banks have set up 90-day forbearance programs, and others are doing this on a case-by-case basis every 30 days.

Regardless, it's important that you contact your lender.

For more information, see the coronavirus response from your bank or financial institution. Quick links to major banks are provided below:

For a full list, click HERE.

Utility bills

Both PG&E and SMUD announced that they would not cut the power for customers who can’t pay for their bills until April 17. Qualified customers would be able to pay for their bills through an installment plan that is divided by months.

PG&E officials said the utility company is also giving additional support for those who are on a low-income and those who have special medical needs that require power.

Internet service

AT&T and Xfinity announced that they both would not charge customers extra fees for not making their payment on time.

AT&T pledged to not disconnect customers’ service for 60 days beginning on March 13. Click here to learn more about how to schedule a late payment.

Xfinity is also allowing customers to choose when they can make their next payment through their account.

The United Way has an online calculator to find the best rates based on location and financial situation.

Student loans

Those who have federal student loans could apply for forbearance that would put a stop to monthly loan payments for at least 60 days starting on March 13.

Those who requested to put a hold on their monthly payments would not be charged interest fees for that period, according to Federal Student Aid.

You would automatically be put on the deferral list if you were unable to make the previous payment.

Credit Cards

Credit card companies and banks are offering different kinds of debt relief, such as waived fees or deferred payments. Check with your lending agency for options.

FOR THE LATEST CORONAVIRUS NEWS,

DOWNLOAD THE ABC10 APP:

►Stay In the Know! Sign up now for ABC10's Daily Blend Newsletter