HOUSTON — The COVID-19 pandemic has changed the ways we’re spending money, including how we’re paying for things.

In a new study by Travis Credit Union, half of Americans said that they’ve been using less cash during the pandemic.

One in three Americans have stopped using cash in recent months because they’re worried about the coronavirus or other health concerns.

The study also found:

- 58% plan to stop using cash completely after Covid-19

- 49% would like to see cash and coins phased out permanently after Covid-19

- 7 in 10 say they foresee a completely cashless future

- 1 in 5 rarely or never carry paper bills

- Only 16% said they always carry cash

- The average amount of cash carried is $46

- 77% believe all businesses should accept cash

Along with credit and debit cards, we now have the option of online payments with Venmo, Zelle, Square and many others.

It’s all about convenience, but there are concerns with a cashless lifestyle, including privacy breaches.

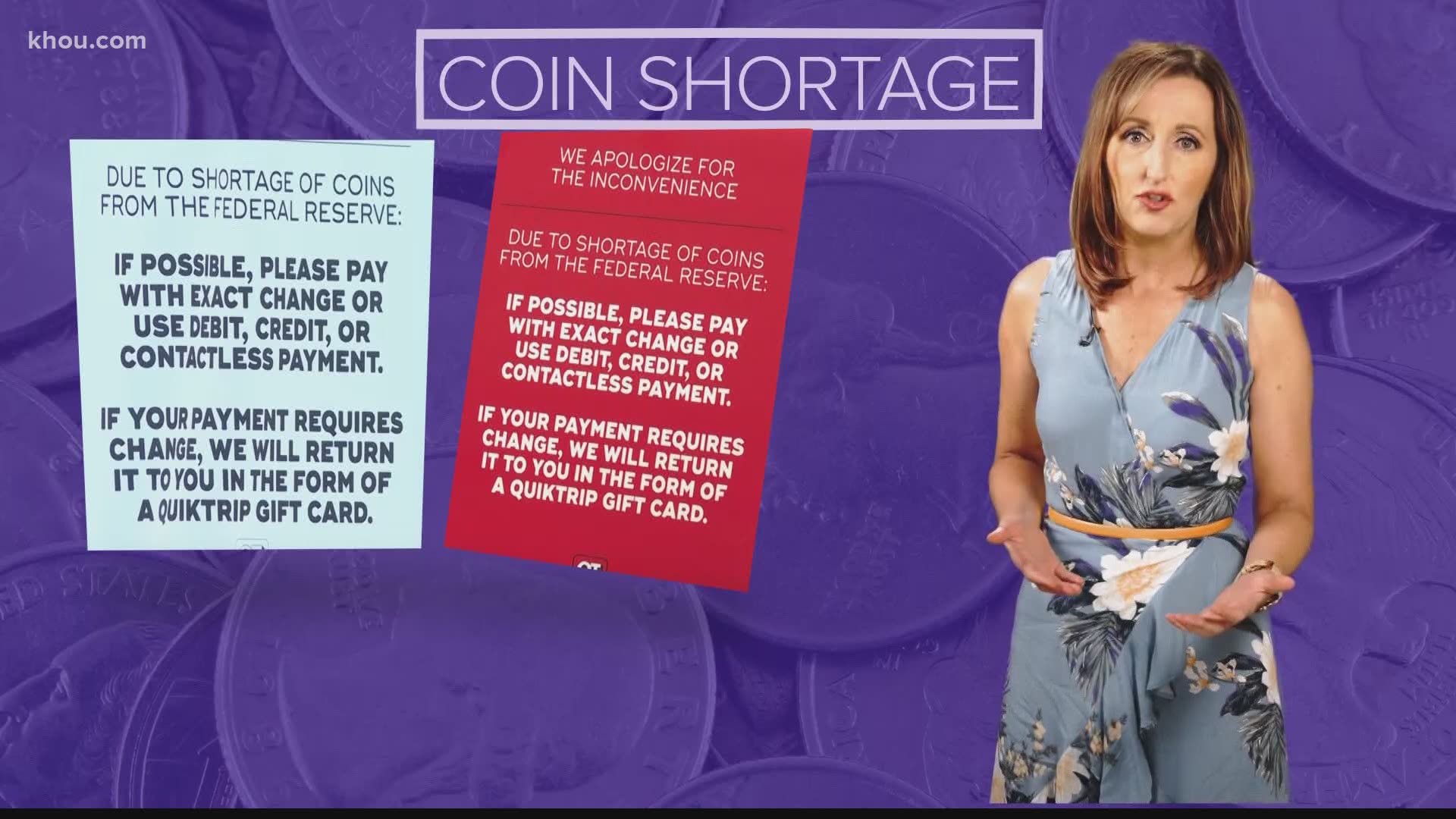

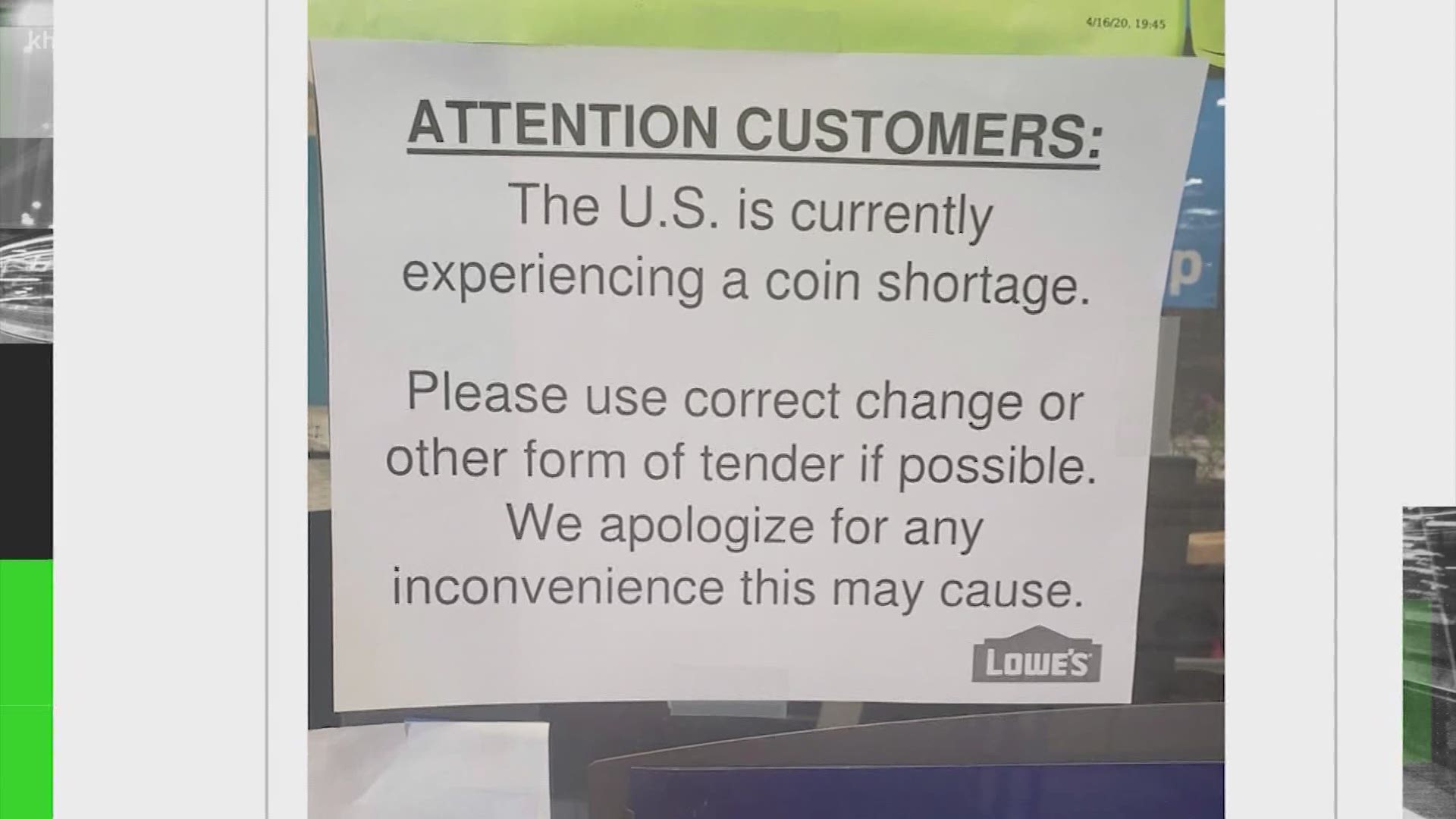

And an unexpected side effect of the pandemic is a national coin shortage related, in part, to the increase in cashless transactions and consumers spending less.