SACRAMENTO COUNTY, Calif. — The pandemic was a wild ride for the Sacramento region's housing market; just ask realtor Dana Harward.

"These homes we're in now... when they went up originally in 2018 just before the pandemic, they were running anywhere from high $300,000 to low $400,000," Harward explained as she drove our ABC10 crew around a popular suburban neighborhood in Natomas.

During the pandemic to now, those same homes are selling for double.

"This one sold for $745,000," Harward said, pointing to a home.

With the ability to work from home, the pandemic brought the power to live anywhere, as well as a demand for more space and with that came competition.

"It felt like a piranha feeding frenzy," said Harward.

A frenzy that appraiser and housing analyst Ryan Lundquist describes as the most "aggressive housing market" he's ever seen.

"I think it's something that was unexpected, where the market went way above where it naturally would have," said Lundquist.

Normally, Lundquist says, the housing market rises for about eight years and then goes back down.

"We were to that point and then a global pandemic happens," said Lundquist. "Lots of people [were] thinking the market is going to go down... there were all these predictions, then it did something nobody expected."

It exploded.

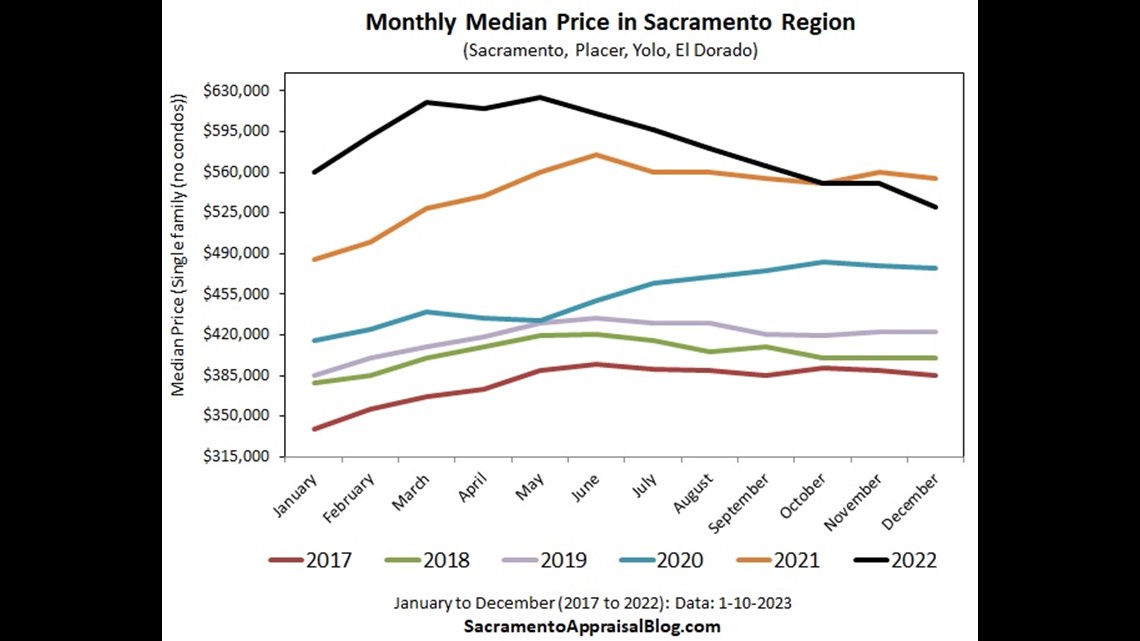

"Where we saw exponential growth, prices up almost $200,000 within two years," said Lundquist. "That's really steep."

With wildly low interest rates, houses in Sacramento and the surrounding region were selling like hotcakes.

"As soon as mortgage rates went below 3% it was like a steroid was injected into the market," said Lundquist.

In fact, Lundquist's data shows while the market steadily grew for nine years before the pandemic, it was nothing compared to growth between March 2020 and May 2022.

During those two short years, the median price of a home increased in our region by 42%, Lundquist says.

"It was really about targeting higher priced homes," said Lundquist.

Many used their equity - selling to buy bigger and newer elsewhere - like from the Bay to Sacramento.

"And also people focusing on Placer County and El Dorado County, where homes were larger," said Lundquist.

In fact, statistics from the North State Building Association show throughout our region Placer County had the most newly constructed homes for six months straight, from May through Nov. 2022.

But things are changing... again.

"We've basically seen the largest increase, the sharpest increase in mortgage rates in the past 40 years over the past few months," said Lundquist.

According to Mortgage News Daily, from late 2020 through 2021, 30-year fixed rates were below 3%. In 2022, they spiked to over 7%.

"Honestly I didn't think it was going to almost change daily like that," said Harward. "That was like, 'Okay, how do I keep my clients calm?'"

Today, rates sit around 6%, which means interest rates are still double from where they stood during the pandemic.

"It's completely changed the market," said Lundquist. "Earlier in the year we were reporting really aggressive housing stats, massive demand and then mortgage rates said, 'Hold my beer.' And we're in this market where the honeymoon is over."

Over, thanks to the Fed and the increase in interest rates to try and control the nation's inflation.

"I've just been telling people it's time to believe the Fed is very serious when they want to see spending decrease to get inflation under control," said Lundquist. "It's like they're targeting housing as the sacrificial lamb on the altar."

Some experts say the Fed's plan may be working, with the U.S. Bureau of Labor reporting the consumer price index - a measure of changes in prices over time - rose less in December than November.

But with continued high housing interest rates, buyers simply cannot afford what they could during the pandemic.

"I started in March with one client where her buying power was $460,000 and now her buying power is $375,000," said Harward.

Brian Ensminger felt this firsthand.

"We were pretty close to, 'Should we continue to rent?'" said Ensminger. "We were seeing interest rates come up and up. The availability was going down."

He and his wife were on the hunt for a home to start their family.

"I would say we toured north of 20 (homes) and put a bid in on close to 10," said Ensminger.

His agent, Alyssa Mezoui, guided him throughout the process.

"One thing I advise my client (on) is, 'Let's focus on the monthly payment. What can you afford? And the area you want to be in,'" said Mezoui.

After a five-month search, they prevailed, making the Ensminger's first-time homeowners just outside Natomas.

"To be able to go in and get something at the range we wanted, with the ability to do what we want - really a perfect fit - for that to happen I think it shows it's becoming a buyer's market," said Ensminger.

High interest rates and a fall in the average price of a home has changed the tune for those selling.

"Well, I think it's hard for sellers to respond," said Lundquist. "I think that sellers were in the driver's seat. They had nothing but glowing headlines for years - they're used to buyers who are offering over asking price, waiving all the contingencies and really saying where sellers are in control."

But today buyers, like Ensminger, appear to be in the driver's seat.

"We were able to buy a home at a time, the place that fed our criteria... I think that's the best we can ask for," said Ensminger.

"Buyers are in a place where they're eyeing prices and it's more difficult to afford so they have time on their side," said Lundquist.

Realtors across our region are seeing this firsthand.

"Now it's going to take a little longer (to sell)," said Mezoui.

"On average we're seeing 60 days," said Harward.

An astonishing comparison to how fast homes sold during the pandemic.

"The pandemic was a week (to sell a house)," said Mezoui.

Specifically, Lundquist's data shows, half of all sales in 2021 took seven days or even less to sell. But that doesn't mean our market is easy for those looking to buy a home.

"Some people look at 7% today and say, 'Stop your whining because I bought my first house in 1982 at 16%," said Lundquist. "Problem is in 1982, that house was $53,000 and so it's a totally different ballgame today."

That's why, he says, currently there's a 40% decline of those looking to buy a home within Sacramento's housing market. Come springtime, the housing market always heats up.

"I think that's a spring thing too like, 'Wow! We're having another child!'" said Harward.

As mortgage rates and housing prices trickle downwards, many are hopeful more buyers will come to the market, but you never know...

"My crystal ball broke so long ago. It has duct tape all over it," said Lundquist. "Let's remember that I don't think anyone predicted the pandemic market that happened."

No matter the market, there's always people needing to move.

"People getting divorced, people getting married, people needing a bigger house," said Lundquist.

Meanwhile, realtors remain in the middle helping both buyers and sellers while riding out our wild housing market.

"Let's not look back to say during COVID that's the normal market. It's not," said Mezoui. "Life happens. You want to move? Let's make it happen."

"Take that one buyer or that one seller and get excited with them!" said Harward. "You're changing their life."

WATCH MORE ON ABC10: With egg prices increasing, this Granite Bay farmer is selling eggs to family and friends