SACRAMENTO, Calif. — "Buy now, pay later" is something you’ve probably seen while shopping online. Under the payment plan, you’d pay the first installment instead of paying the full amount up front.

But is it a good deal or does it set you up for financial trouble?

For Sacramento-based apparel brand owner Farouq Gidado, the option of "buy now, pay later" is all about giving his customers options.

“I think [it] gives you the ability to make that adjustment or enhancement in your life without having to worry about the financial aspect in that moment,” said Gidado. “I grew up not in the best financial situation… for me it’s giving people the avenue to have the ability to get what they want without having the stress of ‘I don’t have the money right now.’”

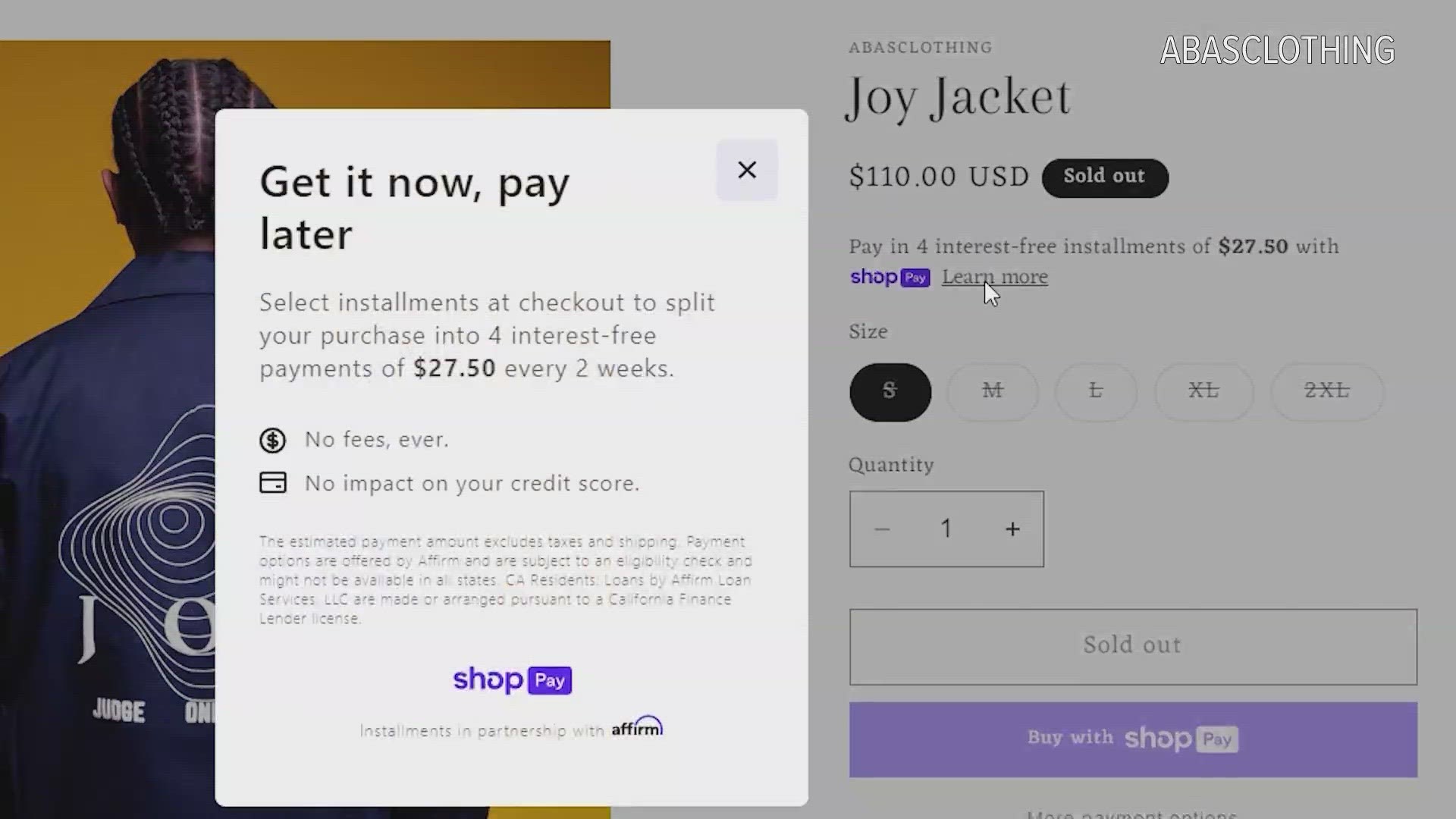

Klarna, Afterpay and Affirm are just a few of the payment options you’ll see when you shop online. The companies offer what’s called a "buy now, pay later" payment plan that can be a smart, no-interest way to break up an expense.

“You're almost always not charged any interest as part of that agreement, so a lot of people like that because they don't want to make a similar purchase on a credit card and then have to pay interest,” said financial coach Maureen Paley.

Generally, the payment method divides your total purchase into a series of equal installments with the first due at checkout. The remaining payments are billed to your credit card, debit card, or bank account until the purchase is paid in full.

For example, say you see a $36 lipstick while online shopping at Sephora. You could either pay $36 right now or use a "buy now, pay later" option like Klarna to divide the payment up into four installments.

“That’s really enticing for us as consumers,” said Paley.

As tempting as it seems, keep in mind you’re still taking on debt and there are risks involved.

“If we eventually fail to make a payment, there is almost always a fee involved. If we don't cover all the payments of that item that we committed to paying [through] ‘buy now, pay later’ [that] organization might report that to collections,” said Paley.

And that’s something that could hurt your credit score.

“The main risk of ‘buy now, pay later’ is that they pretty much make it very easy for us to commit to these installment payments over a period of time, and it's almost like an invitation to overspend,” said Paley.

So, whether you should use the service depends on the plan itself and your financial situation.

WATCH MORE ON ABC10: Restart on student loan payments to begin in October