SACRAMENTO, Calif. — California homeowners face an insurance affordability and availability crisis as at least seven of California’s property insurers, including State Farm and Allstate, have either dropped out of California or are only providing limited fire coverage.

ABC10 To the Point host Alex Bell sat down with nine California congressmembers — four Republicans and five Democrats — asking if it’s time for the federal government to do more.

Five of the nine congressmembers ABC10 spoke with recently introduced bills targeting the home insurance crisis and the issues contributing to it. Here’s a look at what each bill would do.

THE INSURE ACT

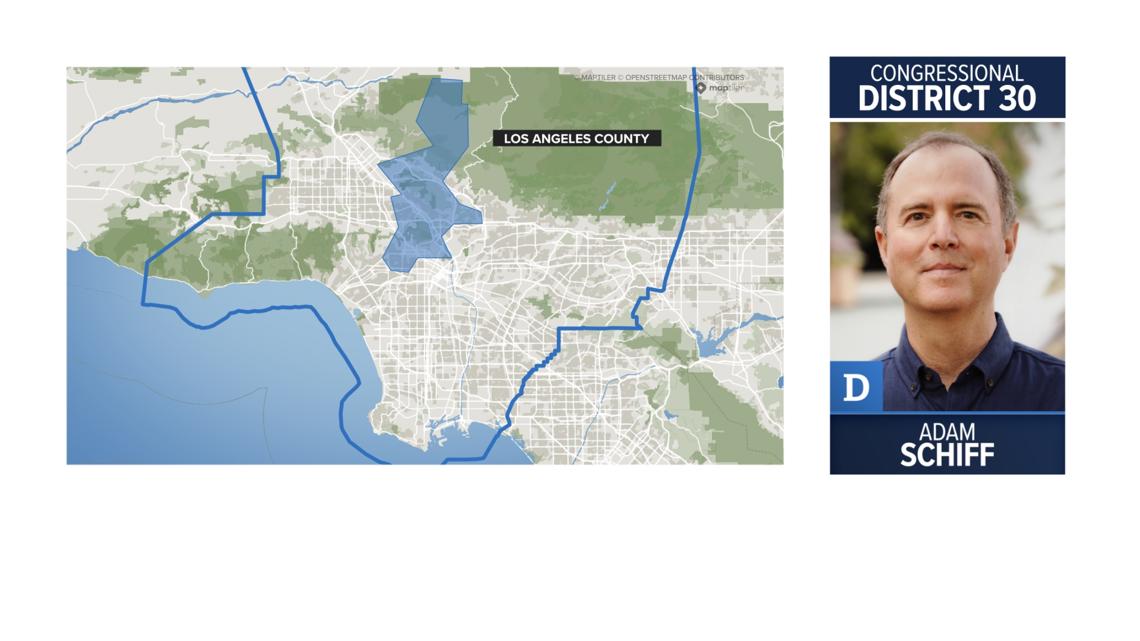

Southern California Congressman Adam Schiff representing California's 30th District authored the INSURE Act. The bill focuses on reducing disaster risks through grants, expanding insurance coverage and stabilizing reinsurance - known as insurance for insurance companies - by creating a federal program for insurers.

"Insurance companies can buy reinsurance from the federal government at a reduced price. The federal government doesn't have to earn a profit on it. The prices would be less erratic. That means that insurers would be able to afford to insure California homes at more reasonable prices,” Schiff said.

Some insurers say rising reinsurance prices add to higher costs for consumers. In exchange for helping insurance companies, Schiff said the INSURE Act would require insurers to insure homes for all natural disasters, including wildfires.

“One of the reasons why I think this is a viable plan, even in a bitterly divided Congress, is this is hitting the red states just as it's hitting the blue states. No one is immune from this,” said Schiff.

PROVEN FOREST MANAGEMENT ACT

Congressman Tim McClintock believes Schiff's bill would only create additional problems.

"It takes us in exactly the wrong direction and we can see that because we can see the failures of the Flood Insurance Program over the years," he said.

McClintock represents California's 5th Congressional District, home to Yosemite National Park, the Sierra National Forest and the foothills near Lake Tahoe. McClintock doesn't believe climate change is the issue impacting the insurance market but rather the country's environmental laws.

"We had healthy and resilient forests and a thriving economy. Those policies were changed in the 1970s by environmental laws such as the National Environmental Policy Act, the Endangered Species Act, that have made the management of our forests endlessly time consuming and ultimately cost prohibitive,” said McClintock.

In 2023, McClintock introduced the Proven Forest Management Act to extend a policy that already exists for the Tahoe basin, streamlining the permitting process for forest thinning projects in the national forest system.

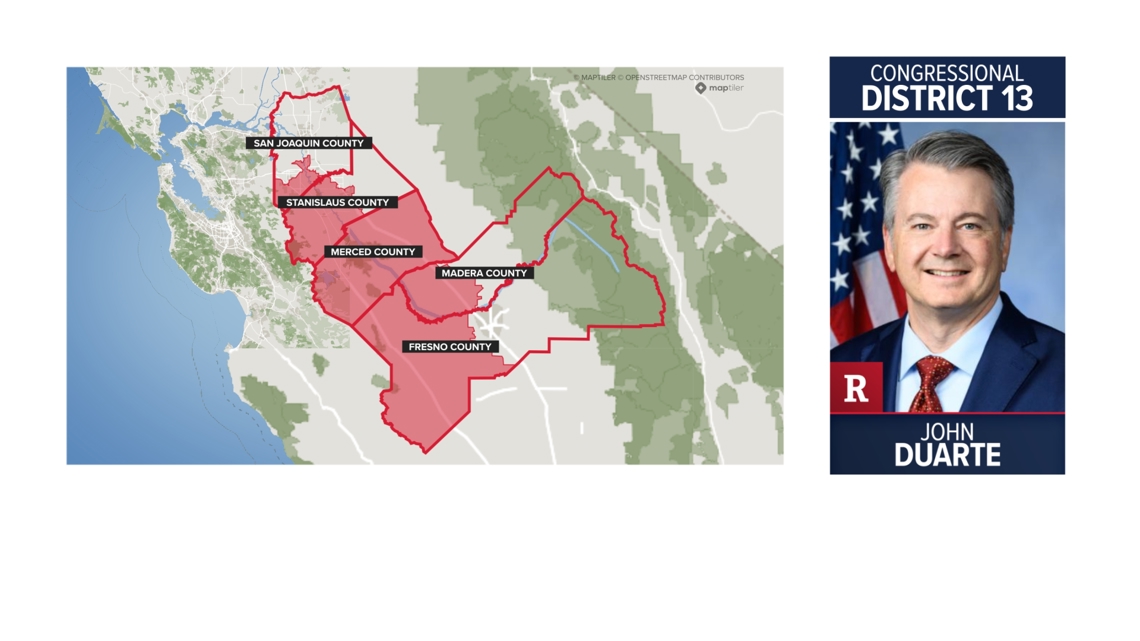

“California has unhealthy forests,” said Congressman John Duarte, who represents parts of the Central Valley in California's 13th District. He also believes thinning the states forests will help.

“We haven't logged them, we haven't thinned them, we haven't actively managed our forests for decades now, and so we're seeing catastrophic wildfires like we've never seen before, greatly due to forest health issues and poor management," he said.

THE SAFE HOME ACT

"If we can give homeowners an incentive to harden their homes, make them more fire resistant, while at the same time giving them financial relief if they choose to do so, I think that's just common sense,” said Congressman Kevin Kiley.

He represents California's 3rd District, home to five national forests and the devastating Caldor Fire. In 2021 the Caldor Fire near Lake Tahoe destroyed more than 1,000 homes and caused $1.2 billion in damages. Kiley says his bill, the SAFE HOME Act, would offer a tax credit to homeowners who protect their property from wildfire, known as home-hardening. Based on income, homeowners could receive a 25% tax credit capped at $25,000 a year.

DISASTER RESILIENCY AND COVERAGE ACT

Congressman Mike Thompson, who represents California's 4th district stretching from Yolo to Sonoma County, authored the Disaster Resiliency and Coverage Act.

"I believe there are some things we can do at the federal level,” said Thompson.

The bipartisan bill creates state grant programs for eligible homeowners to receive up to $10,000 for disaster resistant improvements and gives a 30% tax credit for larger property owners and businesses.

"We found that this program works well. I have experience with it in Alabama, because of hurricanes there...” said Thompson.

The bill would also stop states from taxing payments from state-run disaster resiliency programs and various federal programs.

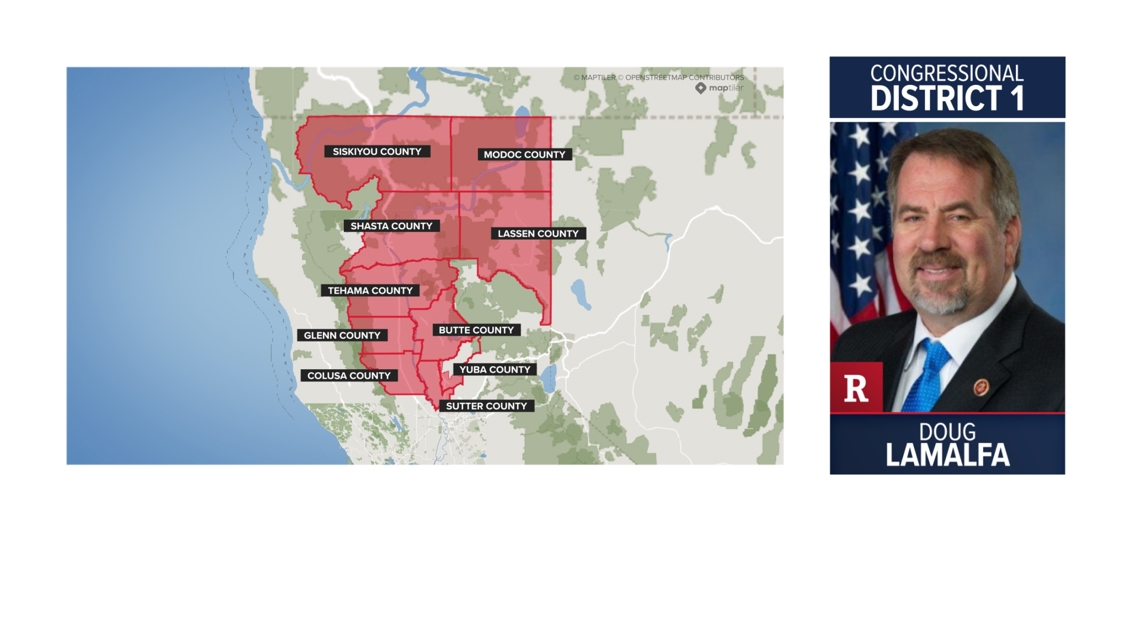

"That'll be very important to shield people being taxed on damages that were awarded to them for being basically fire victims,” said Congressman Doug LaMalfa, a cosponsor of the Disaster Resiliency and Coverage Act.

LaMalfa represents California's 1st District, where the Camp Fire killed 85 people, burned 11,000 homes and left $16 billion in damages.

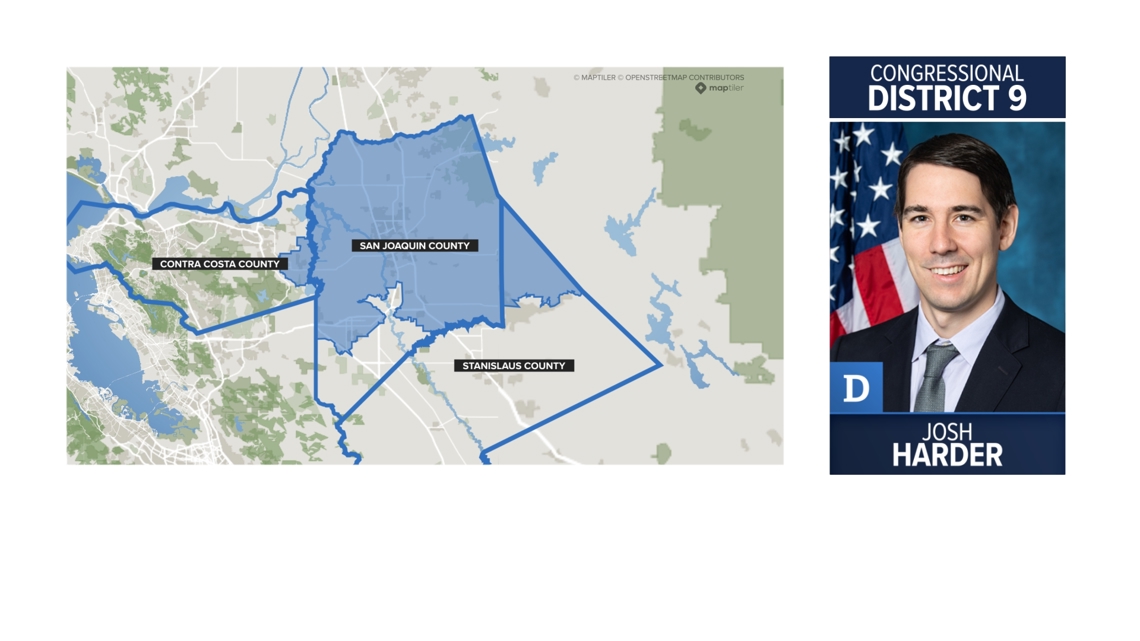

Congressman Josh Harder is another cosponsor of the bill, representing California's 9th District. Harder says it's time for the federal government to step up.

A FIX IS NOT THAT SIMPLE

While all the representatives don't see eye-to-eye on the causes of the crisis and possible solutions, they do agree a fix isn't that simple.

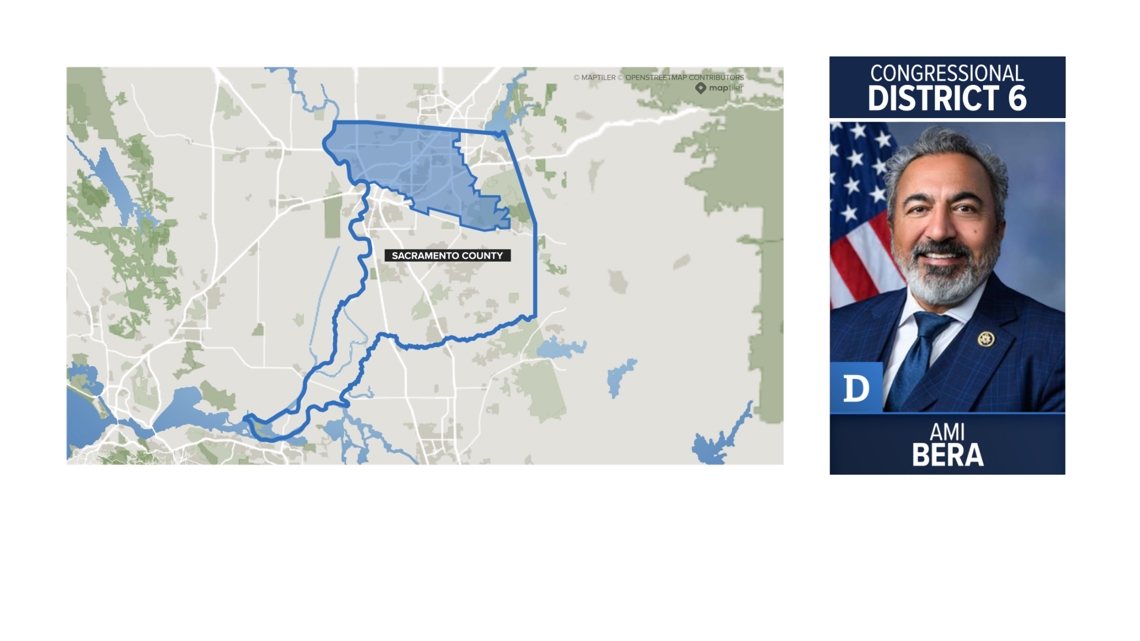

"In the short term, I think it is going to be the states that are going to be the labs that kind of experiment with different ideas, and I think that's what you're seeing in California,” said Congressman Ami Bera.

Bera represents California's 6th District, made up of a large part of Sacramento County. He believes Congress needs a proactive approach to address the insurance crisis but says it will take time.

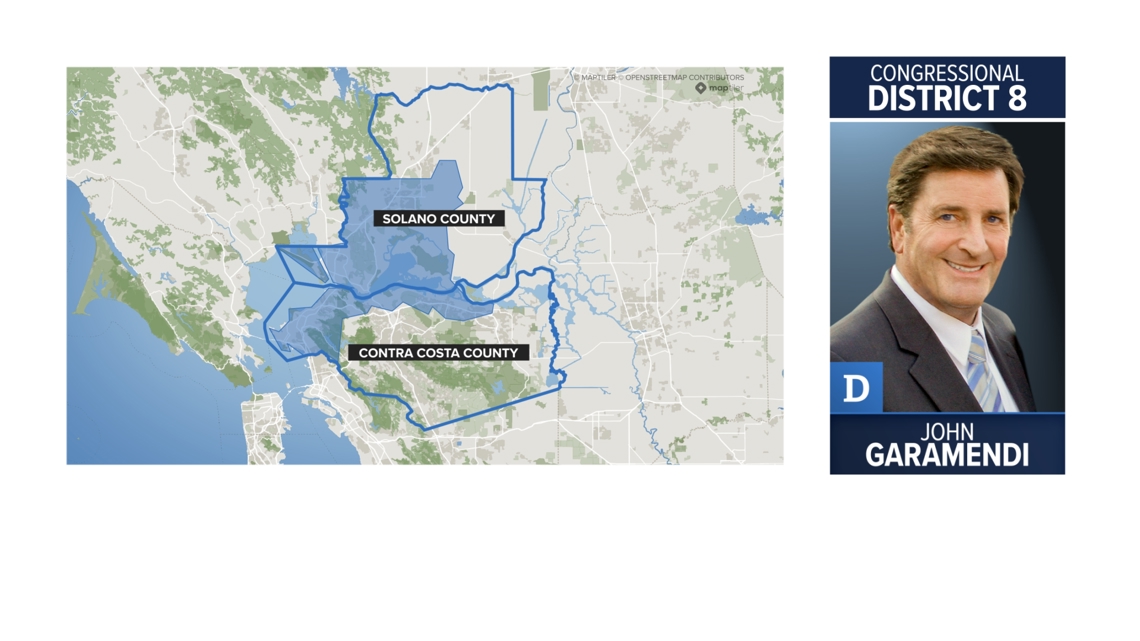

"Not much of anything is happening in Congress these days,” said Congressman John Garamendi, who represents California's 8th Congressional District.

Garamendi, who was California's first elected insurance commissioner, says he’s advocated for a federal catastrophic insurance program for 25 years "however, that has not yet happened in Congress.”

Garamendi says the way he sees it, it’s up to the states to make a change first. He believes California's insurance commissioner Ricardo Lara's plan will hand too much power to the industry he’s elected to regulate.

"It appears to me that power inherent in the office of the insurance commissioner is not used. Now the insurance companies say, 'let us have our way... let us determine the price, let us determine the risk,'” said Garamendi.

In a sit-down interview with ABC10, California Insurance Commissioner Ricardo Lara responded to Garamendi's criticism.

"Well, I think it's really fascinating when you Monday morning quarterback. You know, I wish he would have actually helped because what I'm doing is playing catch up for years of other insurance commissioners not having the courage to make these reforms," said Lara.

Lara also shared more on his strategy to stabilize the insurance market and when Californians can expect relief. Click here for more on the commissioner's interview.