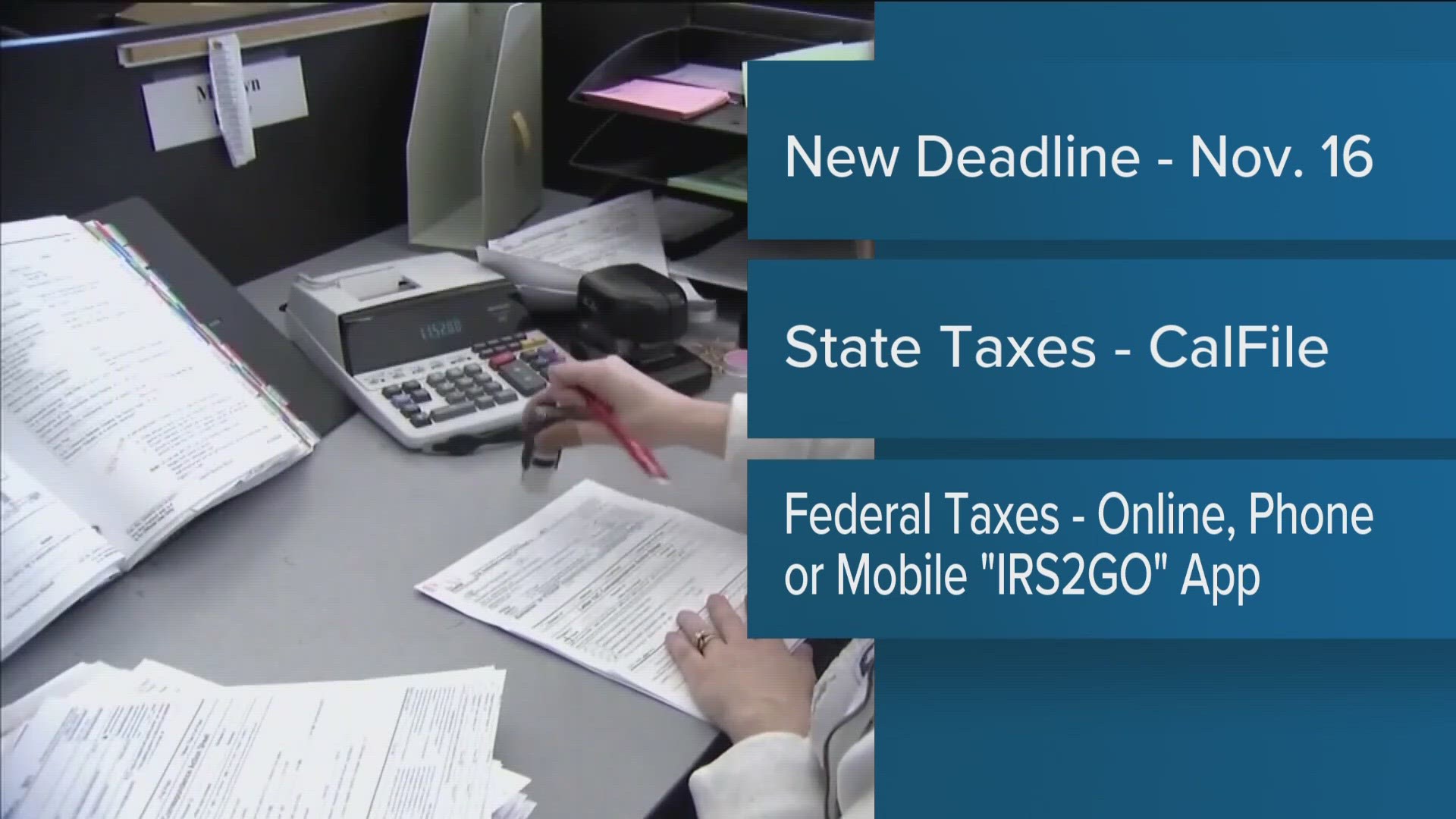

SAN DIEGO — The Internal Revenue Service has extended the tax deadline again for most California taxpayers. The IRS announced Monday morning that the new deadline is November 16.

Taxpayers can file anytime and schedule their federal and state tax payments but it has to be no later than November 16.

"As a result, most individuals and businesses in California will now have until Nov. 16 to file their 2022 returns and pay any tax due. Fifty-five of California's 58 counties—all except Lassen, Modoc and Shasta counties—qualify. IRS relief is based on three different FEMA disaster declarations covering severe winter storms, flooding, landslides, and mudslides over a period of several months," the IRS said in a press release.

The California Franchise Tax Board encourages taxpayers to file their state tax returns electronically, free of charge, using FTB's CalFile program. CalFile and a list of other free services are available on FTB's website.

"I also want to remind Californians that by filing a state tax return they can claim the California Earned Income Tax Credit and the Young Child and Foster Youth state tax credits, if they meet income qualifications. These cash-back credits can put hundreds or even thousands of dollars back in the pockets of families struggling to make ends meet, State Controller and FTB Chair Malia M. Cohen said.

For those filing their federal taxes, they can pay online, by phone, or with their mobile device and the irs2go app. Some other key points to keep in mind when filing and paying federal taxes electronically include:

Taxpayers can pay when they file electronically using online tax software. Those who use a tax preparer should ask the preparer to make the tax payment through an electronic funds withdrawal from a bank account.

IRS direct pay allows taxpayers to pay online directly from a checking or savings account for free. An IRS online account is needed for access.

You can also pay by card. Payments can be made with a credit card, debit card or a digital wallet option.

The irs2go mobile app provides access to mobile-friendly payment options, including direct pay and debit or credit card payments.

For those that don't meet the deadline, the IRS will charge taxpayers a penalty. It's 5% and up to 25% of the amount owed. The fee is retroactive. For more information, visit the IRS website.

What returns and payments qualify for the Nov. 16 deadline?

- 2022 individual income tax returns and payments normally due on April 18.

- For eligible taxpayers, 2022 contributions to IRAs and health savings accounts.

- Quarterly estimated tax payments normally due on April 18, June 15 and Sept. 15.

- Calendar-year 2022 partnership and S corporation returns normally due on March 15.

- Calendar-year 2022 corporate and fiduciary income tax returns and payments normally due on April 18.

- Quarterly payroll and excise tax returns normally due on May 1, July 31 and Oct. 31.

- Calendar-year 2022 returns filed by tax-exempt organizations normally due on May 15.

Other returns, payments and time-sensitive tax-related actions also qualify for the extra time. See the IRS disaster relief page for details.