SACRAMENTO, Calif. — The California Department of Insurance said it is going to return to following deadlines laid out by law, which have been consistently missed in recent years — a problem that has contributed to the state’s insurance crisis.

Under Prop 103 — passed by voters in 1988 — insurance companies must get approval from the Department of Insurance (CDI) before raising customers’ premiums. It’s a process, referred to as a rate filing, that is typically supposed to happen within 60 days, with extensions allowing for up to 180 days (six months) total. In recent years, however, it has ballooned into a much longer process, says Michael Soller, CDI Deputy Insurance Commissioner for Communications.

“Some rate filings do take more than a year,” he told ABC10 on Friday, after Insurance Commissioner Ricardo Lara issued a bulletin announcing CDI’s plans to return to stricter deadlines.

"Under my existing authority granted under Prop. 103, I am issuing this Bulletin to all insurance companies regulated by the Department to increase the transparency and speed of rate change application review and approval times in ways that are beneficial to consumers, the Department, and the insurance market," Lara wrote.

In the bulletin, Lara said he plans on returning to the 60-day deadline, with two 30-day extensions allowed.

Returning to that expedited rate approval process laid out in Prop 103 is something insurance companies have been wanting for years, saying the current, sluggish process doesn’t allow them to raise premiums quickly enough to keep up with rising costs.

Soller said part of the problem is insurance companies presenting incomplete rate filings, leading to a lengthy back-and-forth between the insurer and CDI, as needed documents and data are requested and produced.

“One of the key parts of what Commissioner Lara announced today is, we're going to be creating a new data tool. We're in the middle of doing that right now, so that when insurance companies make a rate filing, we're able to check that data up on the front-end. So before the clock even starts, we know that we'll have data that's complete and be able to start our review,” Soller said. “That's an important part of holding insurance companies accountable, because no one should be playing games here with the data. We need the complete data under the law to review these rates and then to ultimately get to the point where insurance companies are selling insurance again in all parts of the state.”

Getting this data tool up-and-running is key to returning to the expedited rate filing process. It’s part of a larger set of reforms Lara announced back in Sept. 2023, called the Sustainable Insurance Strategy, with a goal of enticing insurers to return to writing policies in all parts of the state once again. In the past several years, seven of the state’s largest homeowners insurance companies, as well as many smaller companies, have paused or limited writing policies in California, citing the rising risks of wildfires, increased costs of building materials and a cumbersome regulatory environment.

"My action gives the Department new tools to hold insurance companies accountable for providing the complete information needed to make informed and timely decisions on these filings, thus reducing unnecessary delays that can otherwise cause rate filings to take longer than expected," Lara said. "Consumers benefit from a thorough and transparent Department rate review process that can bring about more insurance products and greater availability of coverage in California’s insurance market. This action also gives insurance companies greater certainty on their pending filings so we have a more competitive insurance marketplace and support building the sustainability of California’s insurance market."

Consumer group Consumer Watchdog, which frequently participates in the rate filing process and fights for cost increases that are lower than what the insurance companies are requesting, worries an expedited rate filing process will lead to faster, more frequently rising rates for policyholders.

“We remain concerned that the new procedures announced by the Commissioner will short-circuit public participation and rates will be rubber-stamped,” said Carmen Balber, Consumer Watchdog’s executive director.

Returning to expedited rate filings was originally the intent of a so-called trailer bill Gov. Gavin Newsom proposed earlier this year. With Lara’s announcement Friday, in coordination with Newsom, the trailer bill has been pulled and Lara’s bulletin is effective immediately, pending the availability of CDI’s still-in-development data tool.

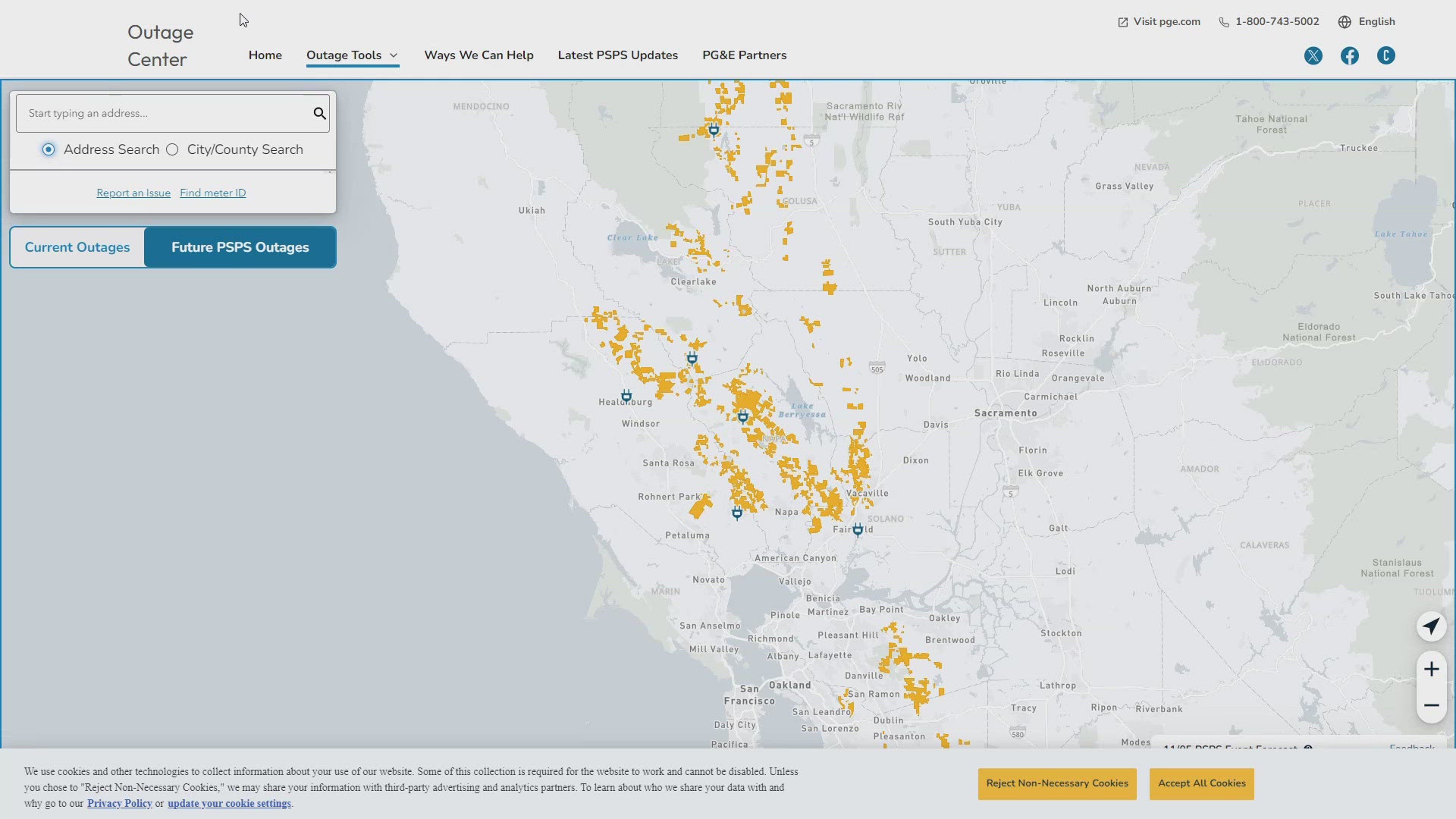

Lara has promised all of the reforms of his Sustainable Insurance Strategy will be in place by the end of this year, “so that starting Jan. 1, insurance companies can start coming to us, writing more policies,” Soller said. “Particularly in areas around Sacramento, El Dorado, up into the Sierra, where right now you can't find insurance at any price, except for the California FAIR Plan, and that's not acceptable.”

Learn more about Lara’s announcement HERE.

For more ABC10 news and weather coverage on your time, stream ABC10+ on your TV for free:

► Roku - click here

► Amazon Fire - click here

► Apple TV - click here

WATCH ALSO: