A small insurance company was found to be insolvent after the deadliest and most destructive fire destroyed thousands of homes in Butte County.

California's insurance regulator has taken control of Merced Property and Casualty Company to protect the claims made by many of the company's clients who lost homes and businesses. According to the California Department of Insurance, "the volume of claims associated with the catastrophic Camp Fire overwhelmed the small insurer to the point of insolvency."

As damage began to be assessed, it was clear there were multiple total losses and mounting claims coming into the company. The company's finances deteriorated rapidly, the department said.

“California law gives us the authority to take over insurance companies that face insolvency. Protecting Camp Fire policyholders who have already suffered through so much was my first consideration,” Insurance Commissioner Dave Jones said.

The California Department of Insurance has expedited the process to file the take over of the small insurance company. It's uncertain how many claims have been filed with Merced Property and Casualty Company since the Camp Fire.

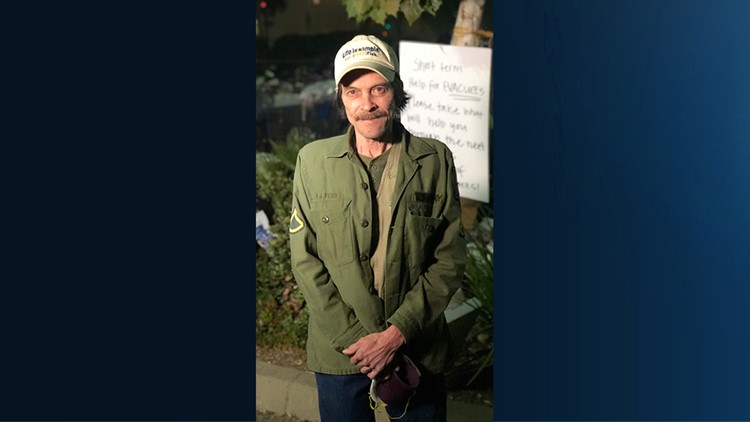

Camp Fire: Faces of the Fire

According to the state, policies with the insurance company remain active for 30 days, but anyone insured with Merced Property and Casualty Company should seek coverage with another insurer immediately. There have been no other reports of insurers in a similar situation after the Camp Fire.

Continue the conversation with Madison on Facebook.