WASHINGTON — The Internal Revenue Service announced on Thursday it's offering another way for individuals or couples to receive their Economic Impact Payment, if they still haven't, and how to get the full amount if they weren't sent the correct total initially.

The IRS said individuals will be able to claim the additional amount when they file a 2020 tax return in 2021. It's called the Recovery Rebate Credit.

Congress passed the CARES Act in March, giving individuals who made $75,000 or less, or couples who made $150,000 or less, a one-time direct payment of $1,200. Those with dependent children under the age of 17 received an additional $500 per child.

But not everyone, particularly those with little to no income, has received their payments.

Saturday at 3 p.m. Eastern is the deadline for some Americans who have not yet received their $1,200 coronavirus stimulus check, or $500 supplemental payment for qualifying children, to apply.

However, if someone doesn't meet the deadline they can still claim their Recovery Rebate Credit if they met the eligibility criteria in 2020. The IRS says those who are eligible include someone who didn't receive a stimulus check in 2020, or their payment was less than $1,200 ($2,400 if married filing jointly for 2019 or 2018) plus $500 for each qualifying child.

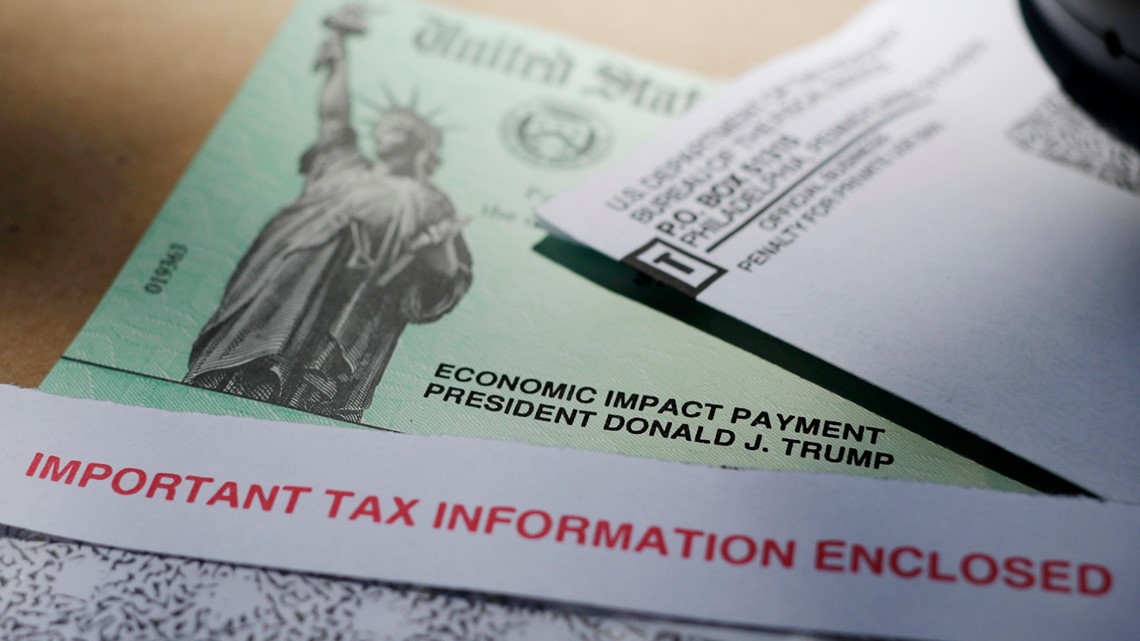

The IRS says individuals must keep the Notice 1444, the Economic Impact Payment, received in the mail regarding the Economic Stimulus Payment with tax records. It said the notice will be mailed to each recipient's last known address within a few weeks after the payment is made.

When filing a 2020 tax return next year, taxpayers can refer to Notice 1444 and claim additional credits on a 2020 tax return if eligible.