SACRAMENTO, Calif. — New numbers from the California Department of Insurance highlight a crisis facing homeowners: Insurance companies have been dropping coverage for hundreds of thousands of customers statewide in the face of increasingly frequent and destructive wildfires.

"Without action to reduce the risk from extreme wildfires and preserve the insurance market we could see communities unraveling,” California Department of Insurance (CDI) Commissioner Ricardo Lara said.

From 2015 to 2018, the 10 counties with the most homes in high- or very high-fire-risk areas saw a combined total of more than 19,300 insurance company-initiated non-renewals in the voluntary market. In other words, insurance companies are dropping homeowners by the thousands because of California's wildfire risks.

Those non-renewals account for nearly 8% of all housing units in those counties — Tuolumne, Trinity, Nevada, Mariposa, Plumas, Alpine, Calaveras, Sierra, Amador and El Dorado.

Add in Butte, Placer and Yuba counties to the list, and that number increases to more than 36,700 non-renewals from 2015 to 2018. Statewide, during that same time, that number is more than 671,300 non-renewals.

Within those 10 counties, new and renewed homeowner policies fell by 8,700. Those counties also saw a 177% increase in the number of homeowners turning to the California FAIR Plan policy, meant as insurance coverage of last resort.

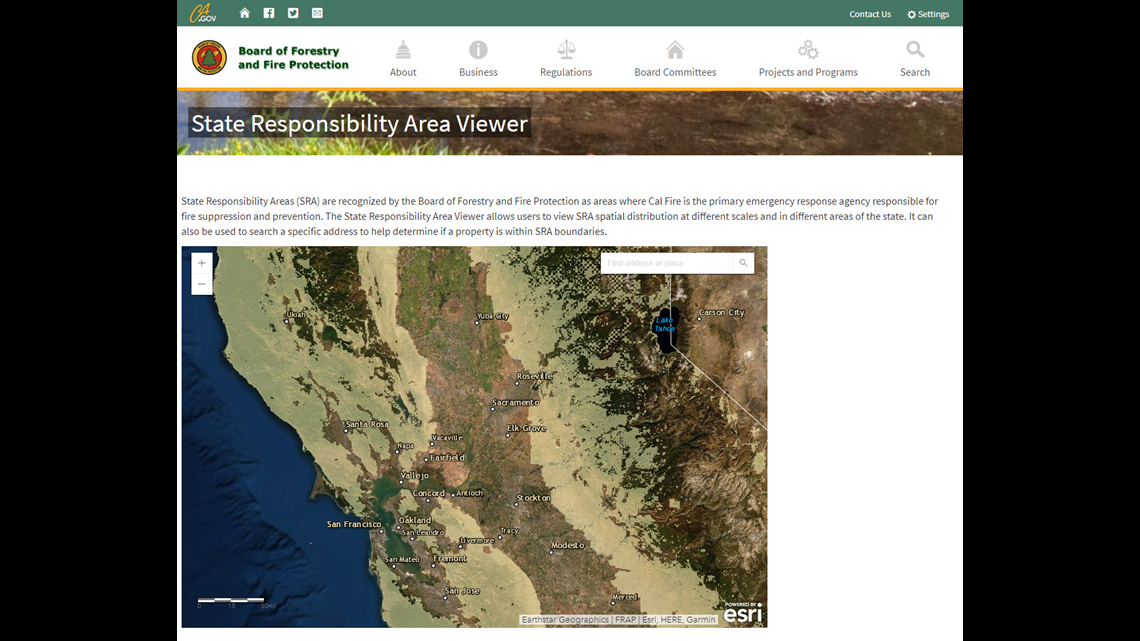

Nearly 57% of new FAIR Plan policies are now written in State Responsibility Areas (SRAs), which are the parts of the state where Cal Fire is the primary emergency responder for fires. That number was 47% in 2015, the CDI says.

New state numbers show there was a 6% increase in insurer-initiated homeowner policy non-renewals in Cal Fire SRAs from 2017 to 2018. That trend was worse for ZIP codes affected by 2015 and 2017 wildfires; last year, those areas saw a 10% increase in non-renewals.

The problem is even worse than the data set shows, as the numbers don’t reflect the many people losing insurance this year in the wake of the destructive and deadly 2018 wildfires, including the Camp, Carr and Woolsey/Hill fires. (Look up your county's impact HERE.)

El Dorado County homeowners Laura and Charlie Callahan know the pain all too well. Earlier this year, the homeowner's insurance company they’d had for more than 20 years canceled their coverage.

“I'm now paying four times what I was paying before,” Laura Callahan said, explaining that the couple is now cobbling together insurance between the FAIR Plan and Lloyd’s of London. “It's gone from less than $1,000 a year to almost $4,000 a year, and we're on a fixed income. He's retired, I'm retiring, and it wasn't something we expected.”

RELATED: 'It needs immediate action' | Homeowners desperate for affordable insurance in fire-prone areas

She and her husband own their home, but she said she knows other people in El Dorado County who “are paying more for their homeowner's insurance than they are for their mortgages!"

What is the California Department of Insurance doing about all this?

For now, officials there are listening. Earlier this month, Commissioner Lara announced he’ll be deploying a Strike Team to the affected areas in the coming weeks and months.

Since 2010, the CDI has seen a 600% increase in complaints related to fire insurance non-renewals in wildfire-prone areas, the department said.

There’s a town hall with Commissioner Lara in Grass Valley at 6 p.m. this Thursday, at the Foothills Event Center. Another one is scheduled in Auburn at 6 p.m., Wed., Aug. 28, at the Gold Country Fairgrounds’ Placer Hall.

At these meetings, the CDI will give a presentation on available resources for affected homeowners and discuss what is being done locally and at the state level. Lara will then participate in a moderated question-and-answer session.

“Our foothills and mountain communities are being hit especially hard by the increasing unaffordability of insurance, so we’re grateful to Commissioner Lara that he’s putting his focus where it’s most needed,” Placer County Supervisor Cindy Gustafson said in a news release about the meeting.

“This is a unique and important opportunity for us to have a conversation about the challenges so many of us are facing,” Supervisor Jim Holmes said. “This is the time for our residents to get their questions answered and make their voices heard.”

County leaders desperate for help

It’s a situation El Dorado County Board of Supervisors Chair Sue Novasel calls "dire."

She told Commissioner Lara about her concerns in a letter dated July 25. Three weeks later, Lara visited El Dorado County and met with leaders.

He told them he "is advocating for new legislation that would require insurance carriers to renew policies for homes that have been hardened against wildfire and are located within a 'wildfire mitigated' community," a news release about the Commissioner's visit said. "The broader concern for wildfire mitigation efforts on public lands was also a point of discussion, since so much of El Dorado County land owned by state and federal government is adjacent to private landowners."

Lara also said he's pushing for "an increase to policy limits under the California FAIR Plan and is seeking to require insurers to provide a 180-day notification period prior to cancelation or non-renewal in addition to the currently-required 45 days and that he has already issued notices to insurers to make sure claims are handled fairly and in a timely manner," the news release said.

Four counties to the north, Plumas County Board of Supervisors Chair Kevin Goss wrote a letter to Commissioner Lara dated Tues., Aug. 20, expressing his concerns about the “astronomical rate increases and cancellations of homeowner insurance policies in Plumas County due to past catastrophic wildfires in California.”

Plumas County has an active Firesafe Council, with 15 Firewise-certified communities and six more working toward the certification, he said.

“Our constituents are doing all they can to protect their homes and properties from wildfires, but we need more help to make sure they can insure their homes,” Goss wrote. “Those that have home mortgages must have insurance, but the options for homeowner insurance are becoming more and more limited or not available at all.”

It’s a crisis that impacts the real estate industry as well, as someone can’t easily sell a home that they can’t get insured.

Plumas County, he added, is comprised of more than 70 percent federal land “that is always at risk for wildfire during fire season, especially after years of low forest management.”

He invited the commissioner to come meet with Plumas County leaders, as Lara has done in counties including Butte, Nevada, Placer and El Dorado.

What is the California FAIR Plan?

The State Legislature helped establish the California Fair Access to Insurance Requirements (FAIR) Plan more than 50 years ago.

“It is an insurance pool established to assure the availability of basic property insurance to people who own insurable property in the State of California and who, beyond their control, have been unable to obtain insurance in the voluntary insurance market,” the plan’s website says.

It’s not a state agency, and it doesn't involve any public or taxpayer dollars. But people who can’t get fire insurance through any other avenue can get it through the California FAIR Plan.

The FAIR Plan is meant as a last resort, and experts recommend that people shop around before resorting to it. (Compare FAIR Plan insurance renewal trends to voluntary market trends HERE.)

So what if my insurance company drops me for fire coverage?

The California Department of Insurance’s hotline, 1-800-927-HELP, can help homeowners determine their next steps. There are also online resources HERE.

Most major insurance companies you’ve heard of are called admitted carriers, but there are other insurance companies where people can get fire insurance. Those are called not-admitted carriers or “surplus” carriers, and they include Lloyd’s of London. (Compare surplus, FAIR Plan and voluntary insurance renewal trends HERE.)

How does my insurance company decide whether to drop me or raise rates?

"Hardening" your house, or making your home and yard as fire-proof as possible by clearing brush and creating "defensible space" – doesn’t make a difference in insurance premiums, El Dorado Hills insurance agency owner Christopher Kerksieck told ABC10 News in May.

Insurance companies use something called a FireLine® score to determine your home’s fire risk and whether to sell you fire insurance – and at what price, Kerksieck said.

“They’re using mapping technology to find out where the house sits," Kerksieck said.

The product's website says FireLine judges wildfire risk on a home-by-home basis using advanced remote sensing and digital mapping technology to determine the effect of the three primary factors that contribute to wildfire risk:

- fuel — grass, trees, and dense brush feed a wildfire

- slope — steeper slopes can increase the speed and intensity of wildfire

- access — limited road access and dead ends can impede firefighting equipment

“That gives a score between zero and 30. The higher the score, the worse it is,” Kerksieck said.

He added that most companies won’t offer a homeowner fire insurance if that person’s FireLine score is above a three. In past years, he said, some companies were insuring people with scores of up to nine.

“We’re seeing very few that are writing above eight now. In those situations, folks usually have to go to the California FAIR Plan, which is supposed to be a last resort. But in a lot of people’s situation, that’s their only resort,” he said.

He said he's seeing average premiums this year that span, depending on the size and location of property and value of the home, from about $1,800 to $5,000.

Continue the conversation with Becca on Facebook.