SACRAMENTO, Calif. — We can get pretty much anything by shopping online — from clothing and birthday gifts to pet supplies and even groceries — and Amazon is the dominant company when it comes to all that.

For many years, it was murky how or whether taxes were applied or collected when shopping online. You may remember those Wild West days of the Internet.

But now, the state of California is cracking down on a 2012 law forcing Amazon to collect California sales tax and, in doing so, telling some third party sellers to pay up.

Specifically, the California Department of Tax and Fee Administration is targeting sellers through Amazon's Fulfillment by Amazon (FBA) service, which bills itself as "You sell it, we ship it."

One such seller is MBW Northwest, "a husband and wife team ran out of our home in Renton, Wash."

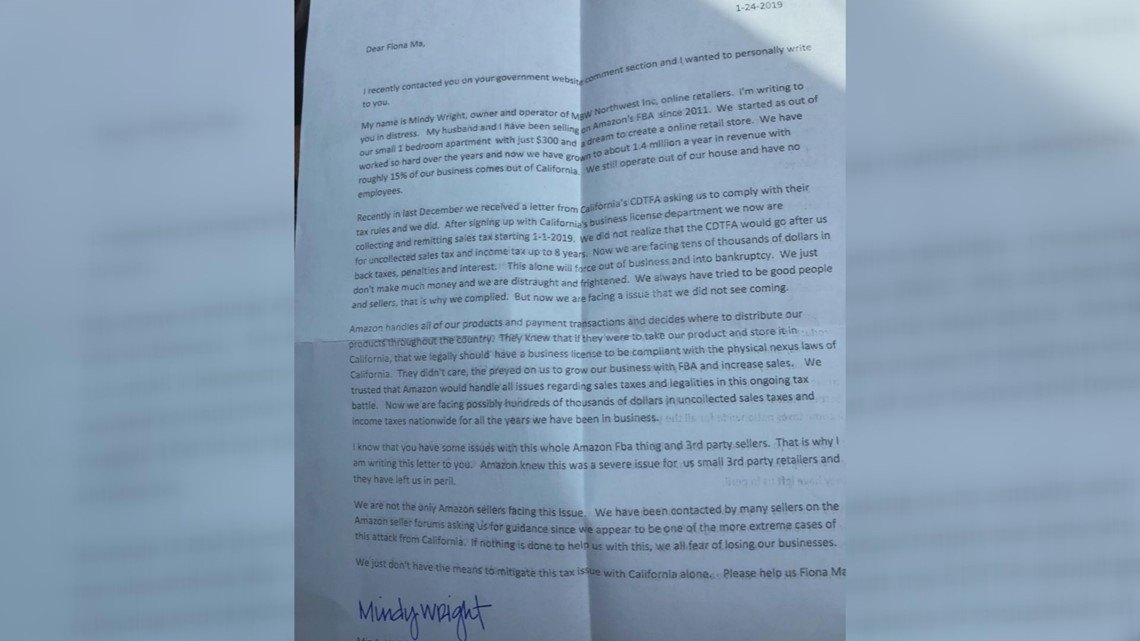

The wife—Mindy Wright—wrote a letter to California Treasurer, Fiona Ma, in which she outlined her situation and fears.

"My husband and I have been selling on Amazon's FBA since 2011,” she wrote. “We have grown to about $1.4 million a year in revenue with roughly 15 percent of our business comes [sic] out of California."

She said the state sent her and her husband a letter in December, requiring them to get a business license in California—which they did, and started collecting and paying state sales tax starting this year.

But the state is now coming after them for tens of thousands of back taxes—something, she says, "we did not see coming."

She blames Amazon for not cluing the couple into California law.

Amazon did not respond to ABC10’s request for comment Thursday evening.

If Wright and her husband have to pay all those back taxes, she said this will "force [us] out of business and into bankruptcy."

For its part, the California Department of Tax and Fee Administration says anyone conducting business in California without a permit is subject to hefty fees—or even imprisonment!

So what does this mean for online shoppers living in California?

Well, if some of these 3rd party sellers go out of business, that means you wouldn't be able to buy from them anymore. On the other hand, the state is missing out on years of uncollected and unpaid taxes.

State Treasurer Fiona Ma passed along the concerns of these sellers to Governor Gavin Newsom. Whether he will – or can – grant any leniency to these out-of-state online retailers through Amazon, we'll see.

Continue the conversation with Becca on Facebook.

________________________________________________________________

WATCH ALSO: Common mistakes to avoid when filing taxes

H&R Block Tax Professional Audrea Herrera sat down with ABC10 to help explain some of the differences, and common mistakes people make, in filing taxes this year.