SACRAMENTO, Calif. — The Golden State Stimulus II payments are expected to start going out to Californians as early as September.

Gov. Gavin Newsom originally presented the plan for the second round of checks back in May. However, there's still a bit of confusion on who will actually qualify for this round of stimulus checks.

THE QUESTION

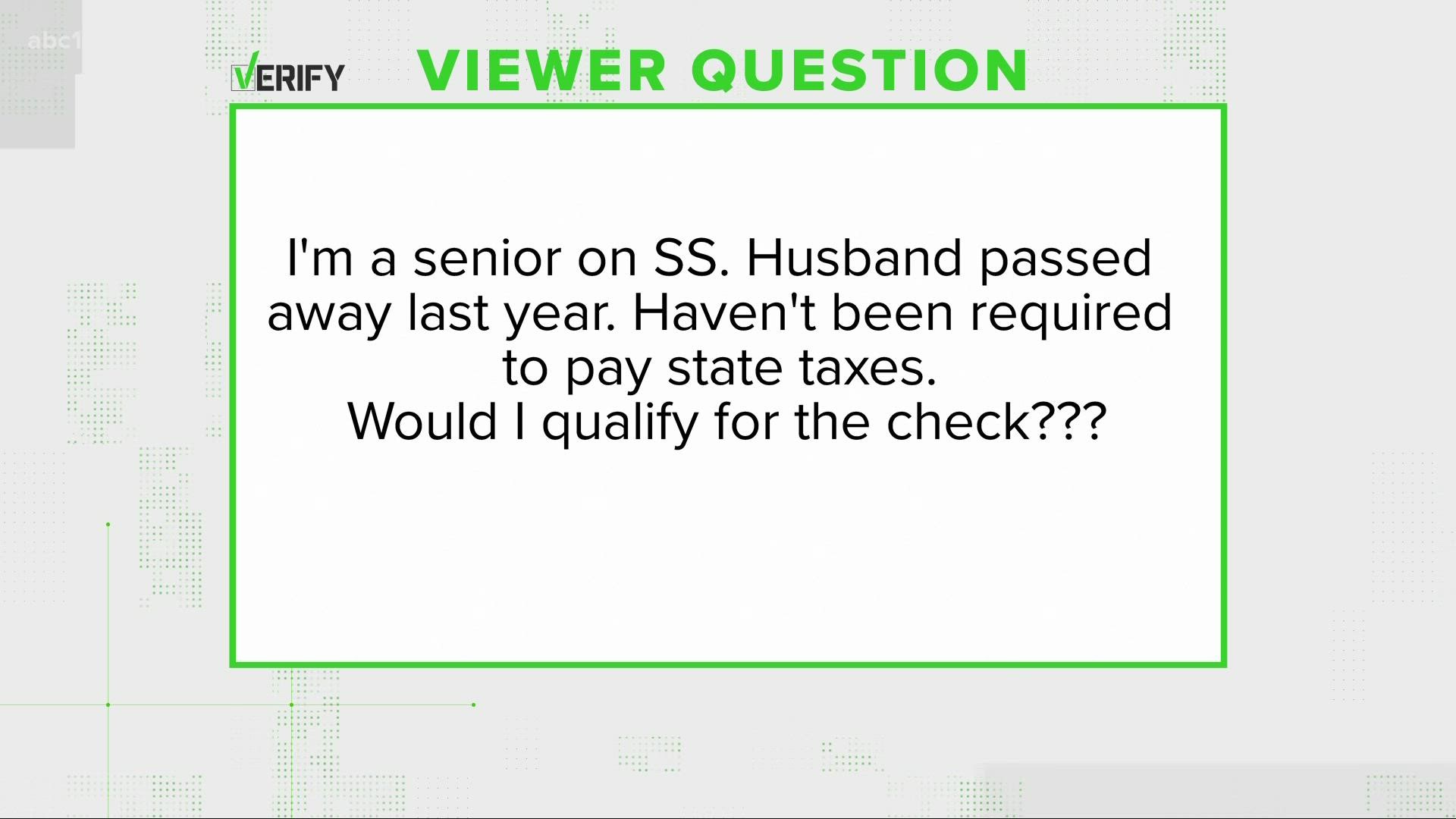

Are non-taxpayers in California eligible for the Golden State Stimulus II?

THE SOURCES

- Andrew LePage, a spokesman for the California Franchise Tax Board

- Assembly Bill 139

THE ANSWER

No, non-taxpayers in California are not eligible for the Golden State Stimulus II. In order to receive the stimulus payment, you must file your 2020 taxes by Oct. 15.

WHAT WE FOUND

"Everyone who will receive Golden State Stimulus II must file their complete tax return," said Andrew LePage, a spokesman for the California Franchise Tax Board.

Assembly Bill 139, just signed by Governor Newsom at the end of June, said a qualified recipient "is an individual who filed a California individual income tax return on or before October 15, 2021."

The California Franchise Tax Board, which is the agency responsible for administering these checks said, in order to qualify, you must have at least $1 and not more than $75,000 of California adjusted gross income.

But most importantly, LePage said, you must file your 2020 taxes by Oct. 15.

"That's how we know whether you qualify or not," LePage said.

As for those relying on public benefits like Social Security, they need some taxable income, even if it's only $1, and they need to file if they want to see any state stimulus money.

"Many people who rely heavily on a public benefit like Social Security but also have at least $1 in some form of income, for example interest among a big savings account, that would give them at least $1 of adjusted gross income," he said.

►Stay in the know! Sign up now for the Daily Blend Newsletter

WATCH ALSO: